#image_title

#image_title

More than 1 million children in the state have benefited from the monthly payments, which will stop unless Congress extends them by Dec. 28.

When they first heard about the child tax credit, Danette and Eric Brown were excited at the prospect of the added monthly income helping their family even as they worried about the tax implications of accepting the money.

The Eau Claire couple decided to accept the funding made possible by the American Rescue Plan Act (ARPA), and those monthly disbursements—totaling $550 for the family of four since July—have made a significant difference.

The Browns have used the extra tax credit money for such expenses as keeping up on their utility bills and putting snow tires on their car. The additional income is preventing them from having to apply for high-interest loans to make other payments, Danette Brown said.

“More than that, it has allowed us some peace of mind as prices are climbing for groceries, gas, clothing and basic needs,” she said. “The child tax credit has allowed us to bridge that gap and let us leap over that hole we find ourselves in a few times a year.”

The Browns’ kids are among an estimated 1.2 million children, or 90% of those in the state who have benefited from the tax credit, with 45,000 being lifted out of poverty, according to the Center for Budget and Policy Priorities.

But the tax credit payments to 61 million American children could end in January if Congress does not vote to extend them before they expire at the end of this year.

The much-debated Build Back Better Act includes a one-year-extension of the monthly payments, but Senate Republicans have not been willing to support the bill, and Democratic US Senators Joe Manchin of West Virginia and Kyrsten Sinema of Arizona have held up its passage with extensive negotiations.

The Internal Revenue Service has said the Build Back Better legislation should be approved by Dec. 28 for the child tax credit payments to continue in January. Since those payments—$300 for each child under age 6 and $250 for children ages 6 to 17—began in July, they typically have been made on the 15th of each month.

RELATED: GOP States Are Getting a Big Chunk of Biden’s Popular Child Tax Credit—Wisconsin Also Above Average

Working families are eligible to receive the credit if they are a couple and earn up to $150,000 or are a single-parent family and earn up to $112,500.

Other people receiving child tax credit money told UpNorthNews they have used it to pay for everything from rent and house payments, to groceries, day care, clothing, and other living costs. Some people said the extra money helped them make up for debts they incurred after losing jobs during the coronavirus pandemic. Others said the funds help them meet financial needs their income doesn’t allow for.

Ashland resident Tiffany Hayes, a mother of three, said the additional $800 per month her family receives has helped them afford daily living expenses. Her family’s income has been reduced as her partner is staying home to teach their three children because of fears about exposing them to COVID-19 at school.

“We are trying to juggle the daily needs of our family on our limited income, and the child tax credit has kept our heads above water,” she said.

If those payments are discontinued, Hayes said, her family would struggle financially. She teaches 4- and 5-year-olds at EverGrow Learning Center in Ashland and is attending classes at Northwood Technical College.

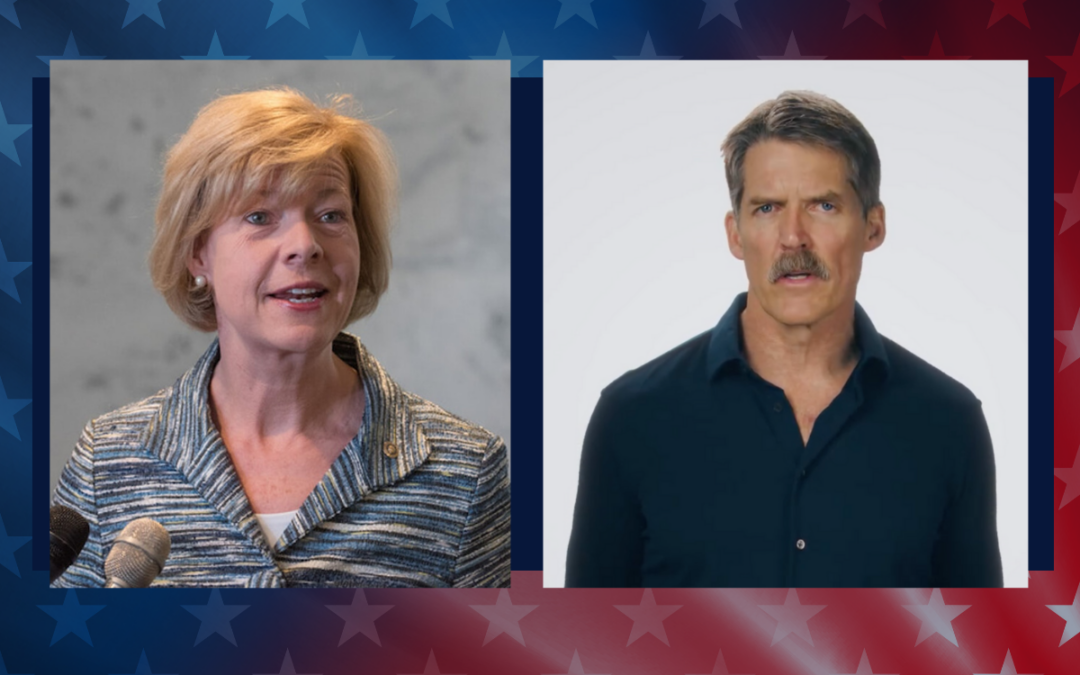

“Losing [the tax credit payments] would leave me in limbo and possibly trying to work more than I am, which seems impossible,” she said. Democratic politicians have spoken in favor of extending the child tax credit, saying it is necessary to help families continue to afford rising expenses, such as child care, that outpace many people’s incomes. US Sen. Tammy Baldwin said such payments are needed to “strengthen the economic security of working families and help lift millions of children out of poverty.”

Politics

What’s the difference between Eric Hovde and Sen. Tammy Baldwin on the issues?

The Democratic incumbent will point to specific accomplishments while the Republican challenger will outline general concerns he would address....

Who Is Tammy Baldwin?

Getting to know the contenders for this November’s US Senate election. [Editor’s Note: Part of a series that profiles the candidates and issues in...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...