#image_title

#image_title

While the end of the eviction moratorium didn’t result in a huge spike in evictions, renters may not be as fortunate in the coming weeks and months.

Just a few months ago, Janesville resident Joshua Crouse was in a good spot financially. He had a steady welding job, stable housing, and was keeping up on all his bills. He went for trips to Chicago with his fiancee and kids. He was able to go out for lunch if he wanted.

Now, not so much.

“A conversation my daughter and I just had about an hour ago was, ‘Can we go to McDonald’s and get some cheeseburgers for lunch since it’s just you and me?’” Crouse said. “Normally? Yeah, sure. But now I have to explain to my 10-year-old daughter who doesn’t really get it why we can’t just shoot up to McDonald’s and get a couple dollar cheeseburgers.”

Crouse has been unemployed since March due to the coronavirus pandemic. He has gotten one unemployment check since then. To survive, he has drained his savings and maxed out two credit cards. He currently has $127 to his name.

His saving grace is the fact a family friend is his landlord, giving him more leeway with how he needs to prioritize bill payments, but he still faces an uncertain future during the pandemic.

Families like Crouse’s represent a growing cross-section of Wisconsinites whose struggles threaten to implode the state economy. About 115,000 households in the state are behind on rent or have deferred payments, and about 150,000 have no or “slight” confidence in their ability to make rent next month, according to the U.S. Census’ weekly Household Pulse Survey. According to an analysis of that data by global advisory firm Stout Risius Ross, about 200,000 Wisconsin households are at risk of eviction.

All of this is against a backdrop of an expired $600 federal weekly unemployment payment boost, a crippling backlog in the state’s unemployment system, inaction from Legislative Republicans, and stalled talks between the House and Senate to pass a new coronavirus relief package.

The state’s 60-day moratorium on evictions also ended on May 26, and it could be just a matter of time before a wave of evictions rips through Wisconsin’s communities. That hasn’t yet occurred.

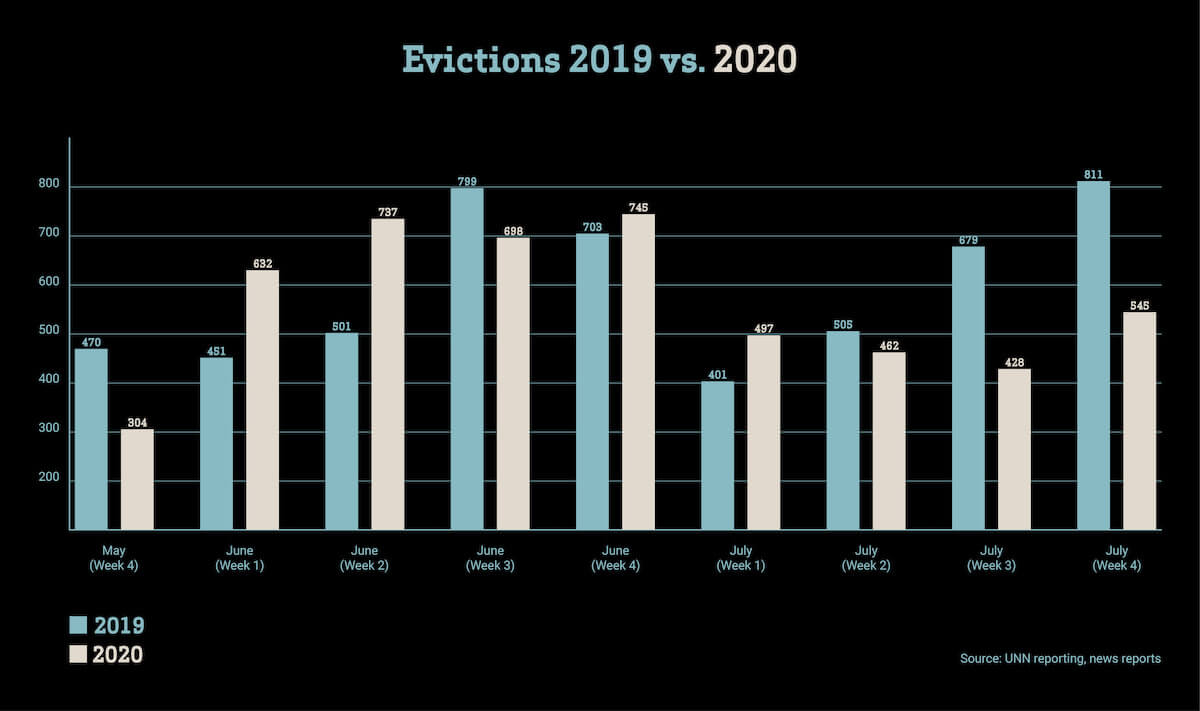

In fact, evictions in the nine weeks after Memorial Day were actually down about five percent overall in Wisconsin compared to last year, even amid the coronavirus pandemic, according to an analysis of eviction filings by UpNorthNews.

Elected officials and tenant advocates told UpNorthNews the decline should be attributed at least partially to the $600 unemployment bonus and federal funding that local governments have used for eviction prevention programs.

“I don’t think it is sustainable long-term,” said Colleen Foley, executive director of Legal Aid Society of Milwaukee. “We are fortunate enough to have this influx of public funding right now … but that will dry up.”

As Foley points out, that positive trend is fragile as long as there is no additional state or federal coronavirus response and the state’s unemployment backlog remains.

House Democrats passed a $3 trillion relief bill in May that would have extended the $600 boost through January and set aside $175 billion for rent assistance and eviction prevention. President Donald Trump and Congressional Republicans are resistant to extending the $600 unemployment boost and instead want to reduce the payment or cap it at an individual’s pre-pandemic income level. Their current proposal for the second coronavirus relief bill includes no money whatsoever for rental assistance.

Former Vice President Joe Biden, the presumptive Democratic presidential nominee, on Saturday proposed an emergency housing assistance package that would extend the unemployment bonus and provide money for local governments to use for eviction prevention.

Biden called for the package on the first day of August, when many tenants had to pay their rent for the month.

Not only would a mass wave of evictions end up in a homelessness crisis, it could also destabilize the economy, sending shockwaves beyond the immediate effects on renters.

“Once that happens, it not only impacts the renter and their family, it impacts the landlord and then in turn impacts the bank and credit unions who may be holding those mortgages,” said Dane County Executive Joe Parisi.

The 200,000 at-risk households in the state account for more than a quarter of all Wisconsin renters, according to Stout. As a whole, the state’s renter population is $220 million behind on rent, Stout estimates. Wisconsin landlords could file 134,000 evictions in just the next four months, according to the estimate.

The situation renters face in Wisconsin is reflected nationwide, where 17.3 million, or over 42 percent, of renters are at risk of eviction and are behind a collective $21.5 billion, the analysis found.

Those numbers are doubtlessly growing every day as the unemployment rate remains incredibly high nationally and in Wisconsin, and the economy descends further into depression-like conditions.

The Economic Policy Institute estimates that without an extension of the $600 weekly federal unemployment payment boost, the sudden and stark drop in buying power for unemployed individuals could cause massive ripples through the state economy. Another 65,000 jobs could be lost in Wisconsin, representing an overnight evaporation of another $3 billion in economic activity, according to EPI.

“There’s a lot at stake here,” Parisi said.

Stuck in line

Like Crouse, the welder from Janesville, Natasha Barnette, a mother of five from Milwaukee, has fallen into the state’s extensive unemployment backlog. She hasn’t received a single unemployment check after 17 weeks of unemployment. Now she finds herself with her life completely upended due to the backlog. She is owed just under $15,000.

“I lost everything,” Barnette said, choking back tears. “I’ve drained my financial accounts…. It’s taking everything not to get my car taken away from me.”

Barnette, a second-shift supervisor at a daycare before the pandemic, began applying for any job she could find. She started last week as a lease manager at a storage facility. She now earns $11 per hour. This is $9 less than the $20 per hour she made at the daycare before the pandemic hit.

Had Barnette not encountered the unemployment backlog, she would be receiving $870 per week before taxes. But with the $600 boost evaporating, the payout would be just $270 pre-tax, the equivalent of about $6.75 per hour.

The state Department of Workforce Development as of July 25 had a backlog of about 169,000 claims made by about 98,000 individuals, DWD spokeswoman Alaina Knief told UpNorthNews in an email.

Claimants are paid everything they are owed when they finally receive their checks, but not everyone has the savings or network of support necessary to afford to survive in the meantime.

Crouse said his single check was for about $10,000 because it was a delayed payout for 13 weeks. Four days after he got his check, he was notified his claims needed to be reviewed again. He hasn’t gotten paid since, but he said he is owed another $5,800. He has to rely on income from his fiancee, who works at a cell phone store, he said.

“Luckily I don’t live on credit, so our cars are paid for,” Crouse said. “Had we had a car payment, we wouldn’t have a car anymore.”

Knief, the DWD spokeswoman, said the department has hired 1,300 new staff to answer calls and review claims since March 14. That hiring surge more than tripled the 500 staff previously assigned to those duties.

Despite that, a backlog remains. Crouse and Barnette said people who answer calls are generally unhelpful and cannot do anything to push claims along. Crouse said he’s left dozens of unreturned calls and emails with the department.

Barnette said three separate people she talked to on the phone tried to explain away the backlog using the same metaphor: That unemployment claimants are waiting for their number to be called in a busy bakery.

“People that are hungry, people that are starved, people that have lost everything — they’re standing in a bakery with a ticket waiting for their number to be called?” Barnette said in disgust.

While Knief did not directly answer how DWD can be helped in expediting delayed claims, Knief pointed to a Democratic bill package introduced in the Legislature in July that is designed to deal with the backlog. Republicans, who have relentlessly attacked Gov. Tony Evers and his administration over the backlog, have not convened the Senate and Assembly to deal with it.

“We’ve got (100,000) people waiting for them to stop fighting about which one of them gets the TV remote tonight before bed,” Crouse said.

‘We kind of need it all’

Rental industry insiders and officials warned a wave of mass evictions could still be in the cards, and reinforced the notion that it would harm everyone in the community.

Judi Moseley, co-chairwoman of the JONAH Affordable Housing Task Force in Eau Claire, said she expects the number of evictions to rise in upcoming months. She is hearing a growing number of reports of people in the Eau Claire area facing eviction, she said.

Foley, the Legal Aid Society of Milwaukee director, said her office has been hearing from concerned renters who are anything but their usual callers. While the Legal Aid Society serves all of Milwaukee County, the lion’s share of calls typically come from poorer areas within the City of Milwaukee. The pandemic has changed that.

“We’ve been getting more phone calls from suburban areas, which to me is just the reflection of the incredible, massive job loss and how many people this is impacting,” Foley said.

Chris Mokler, director of legislative affairs for the Wisconsin Apartment Association, an industry group for landlords, said the association’s members have been incredibly concerned as the pandemic continues raging. Mokler, who is also a real estate agent in Appleton, leads the association’s COVID-19 task force, which meets weekly.

“Eviction doesn’t serve anybody any good,” Mokler said. “Landlords don’t get pride and joy out of doing evictions. They’re costly, they’re time-consuming. Just because you’re doing an eviction doesn’t mean you get paid.”

Some local governments have used funding from the first federal coronavirus relief package to launch eviction-prevention programs, a move that both keeps people in their homes and keeps money flowing through the economy.

Dane County partnered with the Tenant Resource Center for a $10 million assistance program. There have been over 5,500 requests for assistance, totaling almost $10 million, and about $4.7 million of that aid has already been approved, according to Parisi’s office.

That program, coupled with the $600 unemployment boost, has been wildly successful so far, Parisi said.

According to court filings reviewed by UpNorthNews, evictions in Dane County — the state’s second most-populous — since Memorial Day ended up decreasing by about 30 percent year over year. In that span in 2019, Dane County landlords filed 401 evictions. This year, the number was 279.

Local governments should be invested in preventing homelessness, Parisi said, especially during the pandemic. Having an eviction on an individual’s record only creates another hurdle to finding a new home and will make them more reliant on government and community assistance, Parisi said.

“Once you’re homeless, becoming rehoused is much more challenging and much more expensive for both the individual and the community who’s trying to help folks than helping someone who’s trying to stay in their home,” Parisi said. “There will definitely be additional human and economic costs due to the increased number of people experiencing homelessness. And those types of challenges are the ones that can last for years.”

The drop in evictions even extends to Milwaukee, the state’s most-populous county. Filings decreased by about 9 percent, records show, dropping from 2,609 in those nine weeks in 2019 to 2,383 this year.

The story was similar for two of Wisconsin’s third- and fifth-largest counties — Waukesha and Racine — where evictions were filed at a similar rate to last year. Waukesha County evictions were identical, as landlords filed 75 evictions in those weeks both years. Racine’s evictions increased about 5 percent, from 275 to 288.

However, Brown County, the state’s third-largest, saw a significant 12 percent increase in filings from 218 to 245, records show.

The City of Racine used $400,000 of its federal funding for a local eviction prevention program. The program is designed to help up to 300 households pay rent, with a maximum payout of $3,000 per renter, said Vicky Selkowe, manager of strategic initiatives and community partnerships for the city.

Matt Rejc, manager of Racine’s neighborhood services division, said those funds have not been disbursed yet, so it is unclear what effect they may have on evictions there once the program is fully up and running.

But such local programs will end when the funding is up — and with the economy in a severe recession, it’s likely those funds will be gone sooner than later.

“People get into, ‘Well, we need this or we need that,’” Parisi said. “Right now, we kind of need it all.”

Despite bipartisan support for more local funding in the second federal pandemic relief package, the current Republican proposal includes no money whatsoever for local governments or rental assistance programs and would replace the $600 unemployment bonus with a paltry $200, moves likely to displace even more people.

“As people use up the stimulus funding they received, I think we’re going to see another spike in (eviction) numbers,” Moseley said.

Without compromise between the Democratic-led House and Republican-led Senate, struggling Americans’ lifelines via enhanced unemployment payments and local federally funded rent assistance will be suddenly severed.

“I’ve got to believe on evictions that this (slight year-over-year decrease in evictions) is a numbers blip,” said Robert Kraig, executive director of Citizen Action of Wisconsin. “That maybe some landlords are reluctant to evict people for the time being, but given that some of them are hard-pressed to have to make loan payments, that won’t last forever.”

UpNorthNews reporter Julian Emerson contributed.

Politics

New Biden rule protects privacy of women seeking abortions

Under the new rules, state officials and law enforcement cannot obtain medical records related to lawful reproductive health care with the goal of...

Biden marks Earth Day by announcing $7 billion in solar grants

The Biden administration on Monday announced the recipients of its Solar For All Program, a $7 billion climate program that aims to lower energy...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...