Wisconsin Republican Sen. Ron Johnson speaks at a rally with supporters Tuesday, Oct. 25, 2022, in Waukesha, Wis. (AP Photo/Morry Gash)

New reporting from WKOW-TV in Madison has revealed that the trust fund established by U.S. Senator Ron Johnson to benefit his adult children abruptly went from paying hundreds of thousands of dollars a year in state taxes to $0 beginning in 2016.

You can view the full report from WKOW-TV (ABC) here. There’s a lot to break down here, let’s get into it:

- Given the size of the trust, which is clearly worth millions and millions of dollars, the taxes paid annually to the state were considerable, ranging from around $400,000 – $900,000 each year between 2011 and 2015.

- The sudden drop to owing $0 in state taxes is apparently due to the highly controversial Manufacturing & Agriculture Tax Credit enacted under former Wisconsin Governor Scott Walker, a Republican. That tax credit was phased in over several years and has been roundly criticized for disproportionately benefiting the wealthy.

- What’s unclear is how the final “upscaling” of the tax credit, to 7.5%, accounts for the sudden drop in taxes paid by the trust from nearly $500,000 due in 2015 to $0 in 2016.

As your author told the reporter who broke this story, the issue here is not whether the Senator and his family followed the law, there’s no indication they didn’t.

The issue is this rigging of the tax system by people like Sen. Johnson to benefit people like himself has been going on for so long.

Within just the last decade, Republican lawmakers and a conservative Governor first elected the same year as Johnson enacted a tax credit at the state level that allows those at the top to pay less and less in taxes – including, we now know, Johnson’s trust fund.

At the federal level, Johnson himself worked to ensure the 2017 Trump Tax Bill included a carve out that saves his top two donors hundreds of millions of dollars each year.

That level of rewriting the rules for self benefit is disgusting, separate and apart from any question over whether or not it’s legal.

But seeing in black and white how Johnson and his political allies benefit, the situation looks even worse in light of the smear campaign the Senator has been running against his opponent.

Consider, Johnson and his allies have spent millions of dollars criticizing Democratic Lieutenant Governor Mandela Barnes for alternatively being a little late on a property tax bill (since paid in full) and not owing any state taxes in years he didn’t make enough money to owe any under state law.

He has the temerity to try and vilify Barnes for not owing any state income taxes in 2018, which turns out to be the third consecutive year in a row that Johnson’s own trust also owed $0 in state income taxes.

That’s worse than disgusting. It’s shameless.

Politics

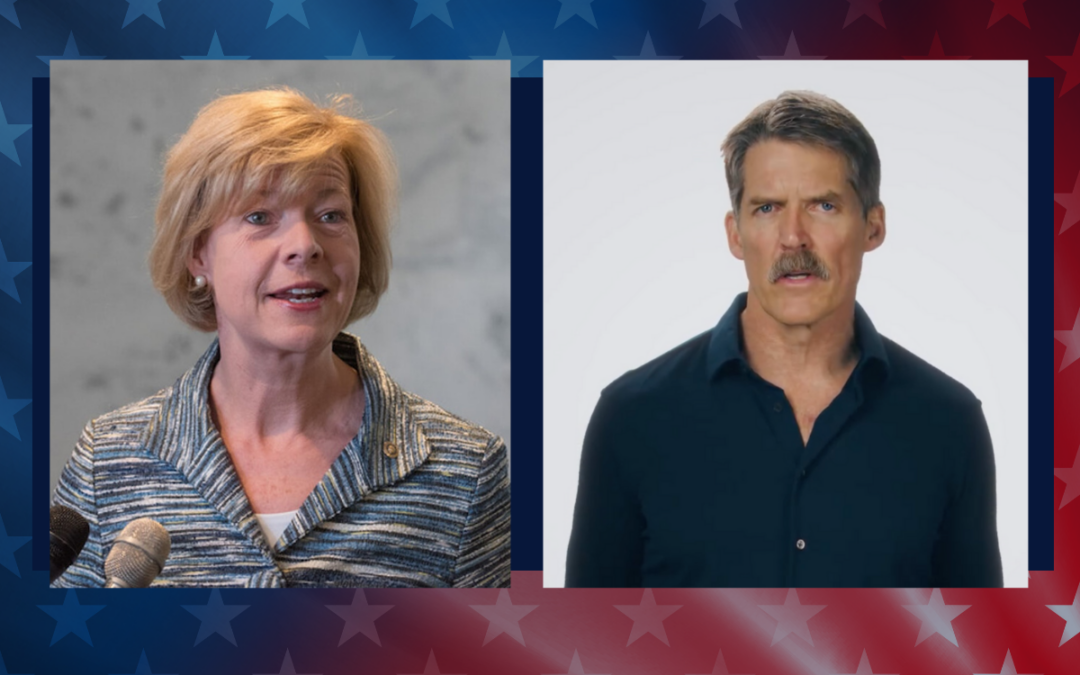

What’s the difference between Eric Hovde and Sen. Tammy Baldwin on the issues?

The Democratic incumbent will point to specific accomplishments while the Republican challenger will outline general concerns he would address....

Who Is Tammy Baldwin?

Getting to know the contenders for this November’s US Senate election. [Editor’s Note: Part of a series that profiles the candidates and issues in...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...