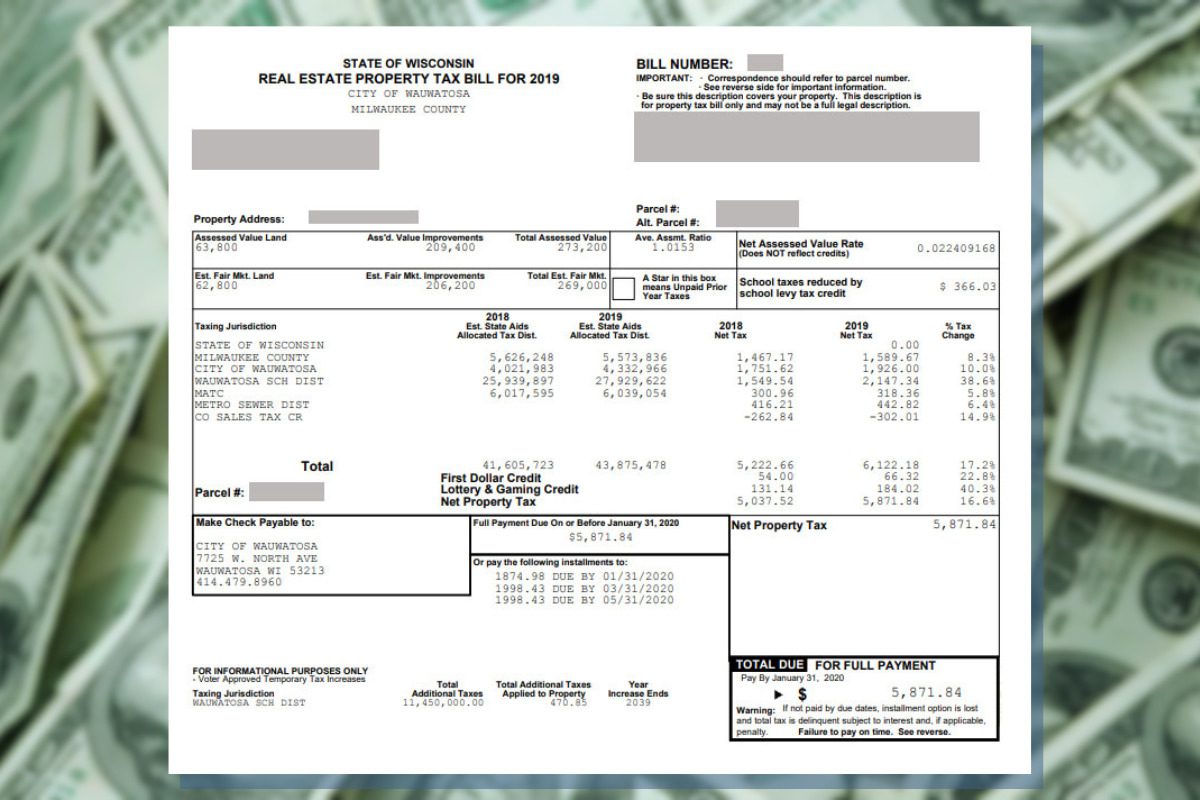

This generic sample of a typical Wisconsin property tax bill shows how it is made up of local taxes levied by a county, a municipality, a school district, a technical college district, and a special sewer service district.

It’s not about greedy school boards, it’s about a Legislature literally passing the buck.

Everyone would like a big year-end bonus—the kind Clark Griswold was expecting in “National Lampoon’s Christmas Vacation.” But most of us end up with its “Jelly of the Month Club” equivalent: the annual bill for property taxes. It’s a bill that is quickly getting larger, but not for the reason some politicians want you to believe.

A new report from the Wisconsin Policy Forum, a nonpartisan research group, details the growing reliance on Wisconsin property taxes by schools and local governments. “Gross K-12 school property taxes in Wisconsin are rising 7.8% on December bills,” the report says, ”the largest increase in more than three decades.”

County property taxes rose about 3.1%, a typical annual increase. Municipalities, technical college districts and special districts (like lake management) round out a typical property tax bill.

But it’s the school district line that’s getting the most attention — and that’s exactly how Republicans running the Wisconsin Legislature for the past 14 years want it.

The report cites preliminary data showing 29% of Wisconsin’s school districts had a levy increase of more than 10% in 2025. The levy is what school districts charge in local property taxes to make up for what isn’t funded by state aid or other small sources.

School districts don’t get a blank check when it comes to the levy. They face state-imposed limits. If the Legislature sends the governor a budget that has ample state aid for school districts, they won’t have to levy as much from local property taxes.

Conversely, the Legislature can also be a Scrooge at this time of year, allocating less state aid, which forces school districts to levy all the way to those state-imposed limits.

This next statistic is all you really need to know: For 16 years, state aid hasn’t kept up with inflation. That is literally passing the buck to local school districts and property taxpayers simply to maintain current services.

The 400-year veto

So why are Republicans in the Assembly and Senate blaming high property tax bills on a veto made by Gov. Tony Evers two years ago? Because “Tony Evers’ 400-year veto” makes for a better political message than, “We keep shortchanging Wisconsin kids.”

In the 2023-25 state budget bill, Evers used a partial veto to strike specific numbers in a way that boosted the state-imposed revenue limit by $325 per pupil annually until the year 2425. It gives school districts a little certainty that they won’t have their limits frozen.

“What Gov. Evers tried to do was give school districts a little bit of an increase to keep up with inflation every year, “ said Heather DuBois Bourenane of the Wisconsin Public Education Network. “The state’s job is to provide the funding so they can spend it.”

That didn’t happen. Republicans responded in the current 2025-27 state budget by freezing state aid at the level of the last budget. That means if school districts want to raise enough funds to keep up with inflation, they have to ask property taxpayers to make up for what the Legislature won’t provide — up to $325 more per pupil.

And they have: Of the state’s 421 school districts, a record 241 had some kind of referendum in 2024 and another 94 in 2025, with a little more than half of them seeing voters approve higher property taxes to make up for the Legislature’s hostility toward supporting public education.

“That’s why your taxes are going up,” said DuBois Bourenane. “The state isn’t paying its share and our kids are paying the price.”

The new state budget did authorize an increase in state funding to cover special education costs in local school districts, but inflation and other extra costs reduced its effectiveness.

Two important notes: First, even that guaranteed revenue increase of $325 per pupil is often not going to be enough to cover inflation while the Legislature sits on its hands. Second, your local school district does not get all of the tax money listed in that line on your property tax bill. Republican legislators have consistently refused demands that taxpayers see the amont of money skimmed off that total dollar amount and put into vouchers for private schools.

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Wisconsinites and our future.

Since day one, our goal here at UpNorthNews has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Wisconsin families—they will be inspired to become civically engaged.

WI teacher: Federal special-ed cuts another blow to struggling state

By Judith Ruiz-Branch A Wisconsin teacher is voicing significant concerns about the recent federal special education cuts and says it’s an...

Wisconsin public school enrollment declines continue as vouchers grow, new data show

Enrollment in Wisconsin's public school districts has continued to fall, while other types of schools are gaining students, according to the state's...

It’s Banned Books Week. Here are some books that faced challenges in Wisconsin last year

Milwaukee librarians are encouraging residents to pick up a banned book this week. Oct. 5 to 11 marks Banned Book Week, where libraries, schools and...

Head Start moms won’t let Washington cut their kids’ future

While many of us were slapping on sunscreen and trying to soak up the last days of summer, moms across the country were dialing—and redialing—their...