Once the writers’ strike is over, can someone help the GOP write a tax cut bill, a plan for affordable childcare, and an election strategy that doesn’t depend on nullifying results they don’t like?

Writer’s block is real. Anyone who does even a little bit of creative writing knows the feeling—an idea is rolling around up there, but it can’t quite find its way to those fingers sitting idly on the keyboard. It’s an understandable dilemma for writers. It’s less acceptable for politicians, however; especially the ones who already know their ideas aren’t very popular. Their policies, priorities, and talking points don’t need editing. They need a rewrite.

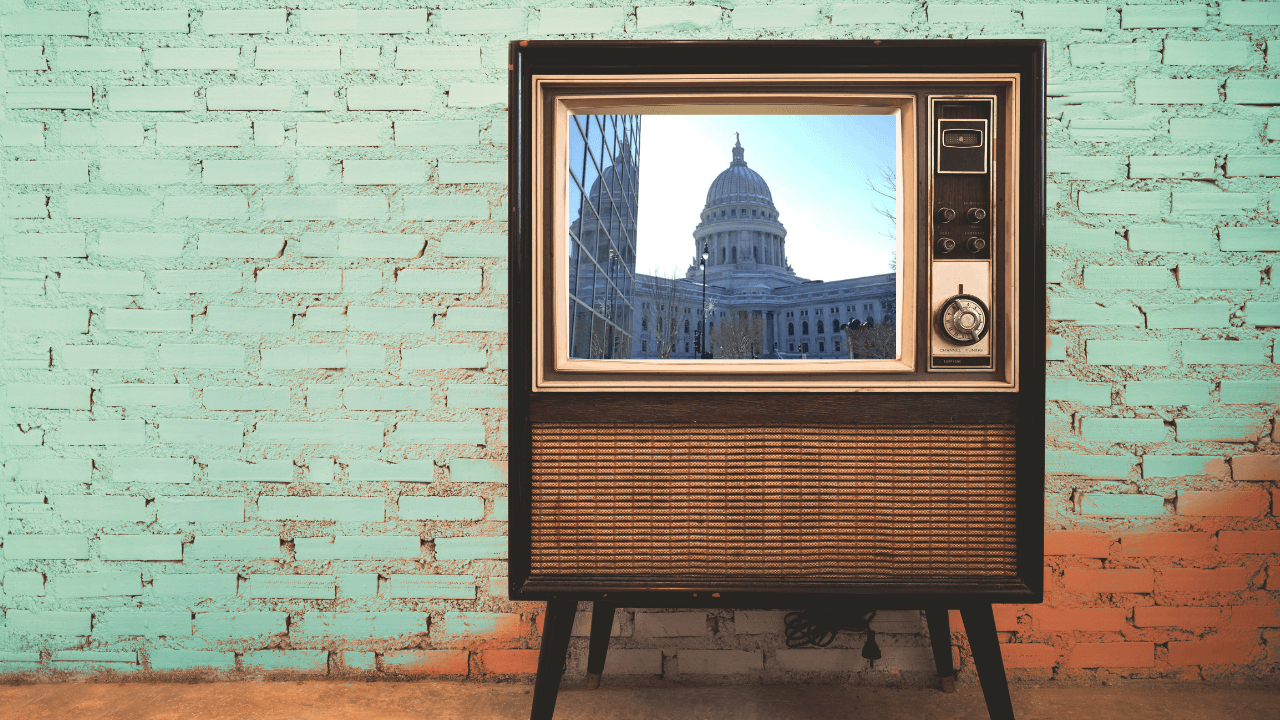

And yet we are stuck with summer reruns from the Republicans running the Wisconsin Legislature. Invited by Gov. Tony Evers to hold a special session later this month and discuss ways to find middle ground on some important issues, GOP lawmakers simply repackaged the same things that got vetoed in the state budget bill. Let’s review their three-part mini-series that could be titled, “I Know What You Did Last Summer. So Do You Want to Try It Again in the Fall?”

Child Care

Anyone with even a passing connection to a job or to parents knows Wisconsin families and the state economy are being pummeled by a double whammy made up of a worker shortage and a shortage of affordable, quality childcare. The labor shortage is crippling some businesses. And the childcare shortage is a serious crisis for families—especially the ones who now have to make do with a single income.

Evers proposed a simple plan: Continue the Child Care Counts program. It was started with federal pandemic relief funds so that essential workers could stay on the job, knowing their kids were being cared for safely. The federal funds are running out, as planned, but Evers and many others believe there’s hardly a wiser investment in our economy than using a fraction of a record multi-billion dollar budget surplus to keep the program going.

The Republican opposition to this is truly baffling and a bit laughable. The argument has something to do with taxpayer handouts to individual sectors, government picking winners and losers, and some of the assistance going to people and providers with higher incomes. But this is coming from the same group that was willing to commit more than $3 billion to the Foxconn boondoggle—and wants to use about half of the budget surplus on tax cuts designed to benefit people at the highest income levels.

They also can’t fall back on their old chestnut about this proposal being heavily weighted toward those big, bad cities with Democratic voters. This is a truly statewide problem, and every Republican lawmaker’s district has providers and parents who have contacted them to ask for help. Nobody can tell you a political downside to helping families and businesses.

Yet all Republicans are offering for the fall session is a warmed-over version of their plan for a revolving loan fund (really?) and their go-to talking point about deregulation—which involves packing more kids into each room and reducing an age limit so that more teenagers can watch younger kids. Hardly the solution anyone affected by the problem is clamoring for.

Tax Cuts for the Wealthy

Anyone who listens to our morning radio program has heard my response to Republicans’ defense of overwhelming tax cuts. When they say “you can spend your money better than the government,” the instant answer is: No, you can’t—unless you filled a pothole today, put out a house fire, taught a classroom of 20 screaming kids, and treated my home’s wastewater so that nothing toxic is released back into the Chippewa River. The whole point of paying taxes is about using some of our money to perform the services that keep our communities healthy, educated, and safe.

That is not a call for a blank check. Of course, taxes can be too high. We expect elected officials to responsibly review our collective checkbook year after year and right-size our tax bills. With a $7 billion surplus, this is certainly a good time to consider tax changes—short-term and long-term.

It was entirely predictable that a Republican tax cut plan would be heavily skewed toward the wealthiest filers—as equally predictable as Evers’ striking that out with his veto pen. The Republican rewrite was released this week and the tax relief is skewed this time toward—the SECOND-highest tax bracket!

Power Politics

Long before Donald Trump tried to nullify a presidential election, Wisconsin Republicans were writing the book on how to at least minimize the impact of losing elections for governor and attorney general. They famously held a lame duck session in December 2018 before Evers and Josh Kaul officially took office in order to remove some of their powers. And after the 2020 election, GOP legislators authorized former state Supreme Court Justice Michael Gableman to try to find any (ANY!) of the alleged irregularities in Biden’s Wisconsin victory—an empty fishing expedition that has cost taxpayers well over $1 million.

The lack of success in 2020 isn’t stopping Republicans from trying to nullify an election in 2023. New progressive Justice Janet Protasiewicz hasn’t even heard a case yet and GOP leaders are talking openly about impeachment. And a legislative committee has begun its attempt to fire Meagan Wolfe, the nationally-regarded administrator of the Wisconsin Elections Commission. The commission has not actually sent the Senate a request to act on the matter, so the Republicans are going through the motions to consider and reject an imaginary nomination. I would normally say you can’t make this stuff up, but they literally did.

There it is: the GOP’s three-part plan to recycle old plans and divisive tactics. It is certainly keeping in the spirit of the moment since the writers’ strike in Hollywood has left us with almost nothing but reruns as we head into fall. We can only hope the strike is resolved soon and that someone is called to Madison to help the majority craft some new ideas, rooted in what their constituents want and need in their daily lives.

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Wisconsinites and our future.

Since day one, our goal here at UpNorthNews has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Wisconsin families—they will be inspired to become civically engaged.

New Biden rules deliver automatic cash refunds for canceled flights, ban surprise fees

In the aftermath of a canceled or delayed flight, there’s nothing less appealing than spending hours on the phone waiting to speak with an airline...

One year on the Wienermobile: The life of a Wisconsin hotdogger

20,000+ miles. 16 states. 40+ cities. 12 months. Hotdogger Samantha Benish has been hard at work since graduating from the University of...

Biden makes 4 million more workers eligible for overtime pay

The Biden administration announced a new rule Tuesday to expand overtime pay for around 4 million lower-paid salaried employees nationwide. The...

‘Radical’ Republican proposals threaten bipartisan farm bill, USDA Secretary says

In an appearance before the North American Agricultural Journalists last week, United States Department of Agriculture (USDA) Secretary Tom Vilsack...