#image_title

Income inequality has been skyrocketing for years. Here’s what Trump and Biden plan for your taxes.

Middle-class families in Wisconsin have as much buying power as they did 25 years ago, while the state’s billionaires have been making money hand over fist even amid the coronavirus pandemic.

Both President Donald Trump and Democratic presidential nominee Joe Biden promise to lower tax burdens and increase earnings on Americans if elected. Biden’s plan specifically focuses on closing the wealth gap and boosting earnings for middle class Americans, while Trump’s plan simply says he would “cut taxes to boost take-home pay.”

US Census data compiled by the Federal Reserve Bank of St. Louis shows median household income in Wisconsin, when adjusted for inflation, is practically equal to what it was in 1995. Median household income in Wisconsin was $67,355 last year, which is better than 1995’s raw amount of $40,955. It only looks better on paper, though; the median Wisconsin family in 1995 took in $68,440 when adjusted for inflation.

At the same time, Wisconsin’s upper-class residents have enjoyed massive income growth. Earnings of the state’s top 1% increased by 130.7% from 1979 to 2014, while the bottom 99% saw income grow just 9.2%, according to a 2017 study on wealth inequality from the Wisconsin Budget Project. Just 56.9% of the overall wealth growth went to the bottom 99% in Wisconsin, the study found.

“The widening chasm between the very highest earners and everyone else poses hardships for Wisconsin’s families, businesses, and communities,” the study authors wrote. “Families can’t thrive when income growth is nearly non-existent for everyone except those at the top, and businesses need a strong middle class bolstered by broad-based income growth to generate customers.”

The economy is routinely a top issue when voters head to the polls—and 2020 is no exception.

Despite the Trump administration’s insistence that it has been good for the economy, Wisconsin’s working class has seen wage growth grind to a halt. Median income growth rose just 2.2% in Wisconsin during Trump’s first two years in office, according to an analysis by the Economic Policy Institute and nonprofit publication Capital and Main.

Even before the pandemic, Wisconsin’s middle class was stagnant. In 2000, 59.7% of Wisconsin households were considered middle class, according to analysis by the Pew Charitable Trusts. By 2017, that number dropped to 55.7%.

Income disparities between top and bottom earners is likely to grow in the years to come.Trump said his historic 2017 tax legislation would focus on “helping the folks who work in the mailrooms and the machine shops of America,” but a study from the nonpartisan Tax Policy Center found that 65.3% of the tax savings went to America’s top 20% of earners. By 2025, top earners’ savings will grow to 65.8% of the nation’s tax relief under the law.

The problems caused by those tax cuts have only been exacerbated by the pandemic. Trump’s refusal to take the coronavirus seriously—by delaying testing, encouraging states to reopen quickly, and not enforcing a national mask mandate—continues to crush middle class Americans who work jobs that can’t be done from home or without child care.

Trump’s second-term agenda says he will further cut taxes, but it doesn’t say how he would do that, and who would be helped by those further cuts.

Biden’s plan centers on preventing tax increases for most Americans, though the Tax Foundation estimates take-home pay would drop an average of 1.7% for Americans, while the top 1% would make about 6.5% less and the country’s GDP would fall 1.47%. Biden has repeatedly said taxes won’t go up on workers who make less than $400,000 per year and pledged to limit deductions, breaks, and loopholes for those who make more to help offset the toll the pandemic has taken on working-class Americans.

Here’s what else to expect in Biden’s tax plans:

- Increase the tax rate on the highest income earners (about $518,000 or more) from 37% to nearly 39.6%. That is the rate this group was taxed at before Trump’s tax bill approved by Republicans who controlled Congress at the time.

- Cap some deductions for the wealthiest Americans, meaning potential tax increases for some individuals or families who make $400,000 or more.

- Make the wealthiest Americans pay a proportional share of Social Security taxes. Right now, any income above $137,000 isn’t taxed for Social Security. Biden’s plan would restart the tax on any income above $400,001. It would also close that gap over time, so everyone is paying a portion of their full salary into Social Security, regardless of how much money they make.

- Currently, earnings from investments are taxed at only about half as much as regular income, disproportionately benefiting wealthy Americans (only 22% of Americans making less than $40,000 per year own stock). Biden would tax investments like real estate and stock over $1 million at the same rate as regular income.

- Raise the corporate tax rate to 28% from 21%, and impose a 21% minimum tax on foreign earnings to cut down on offshore tax avoidance.

- A minimum 15% tax on corporate book income so corporations cannot avoid paying taxes altogether.

“What It Means” is a series on how President Donald Trump and former Vice President and Democratic challenger Joe Biden differ on the big issues impacting Wisconsin.

Opinion: It’s time for Congress to fight for small businesses instead of big corporations

May is National Small Business Month. Our elected leaders need to show leadership all year long. For the past 27 years I’ve been fortunate to pursue...

Biden makes 4 million more workers eligible for overtime pay

The Biden administration announced a new rule Tuesday to expand overtime pay for around 4 million lower-paid salaried employees nationwide. The...

Opinion: Look for the helpers

In this opinion piece, Wisconsin resident Mary Vitcenda urges voters to vote in line with their values and “look for the helpers” as they cast their...

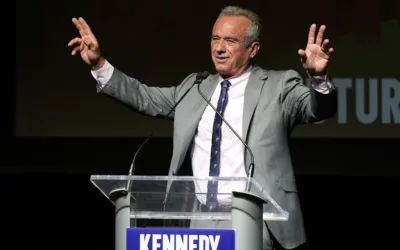

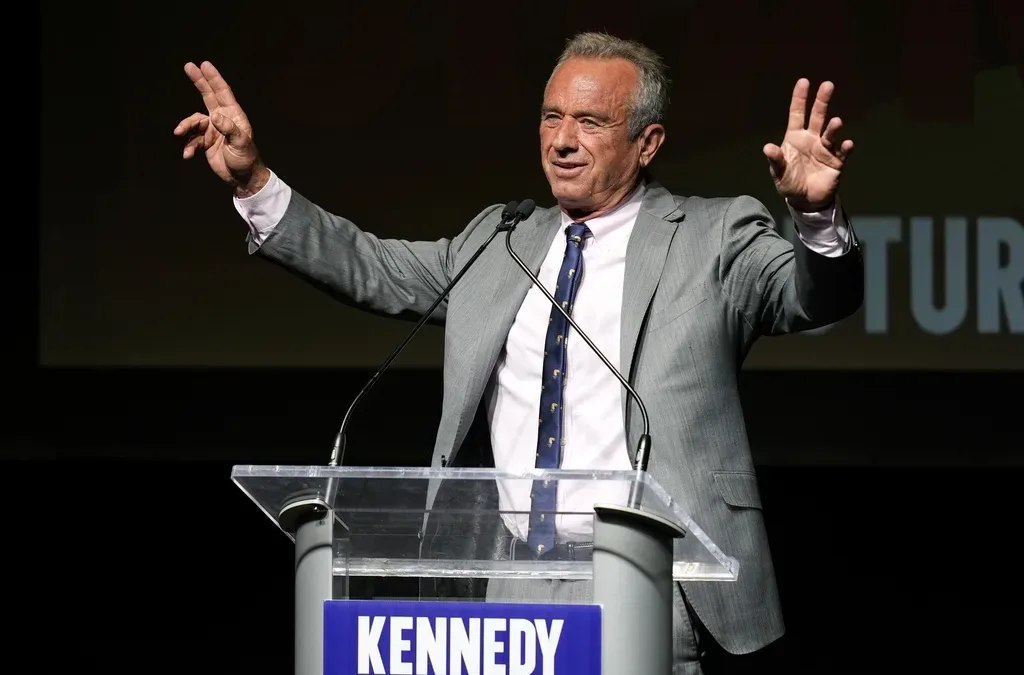

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...