(enzojabol/patpitchaya/Getty)

A Wisconsin advocate shares her experience advocating for fair taxes during her visit to Washington, DC.

Recently, I had the opportunity to join hundreds of advocates and leaders from 22 states to visit our elected officials in Washington and ask them directly to support a tax code that helps working families and seniors succeed, while making those at the top finally pay their fair share. I even told my congressman, US Rep. Bryan Steil (R-Janesville), how important this issue was to me. Now, I hope he listens.

The Republican Tax Law passed in 2017 disproportionately benefited the largest corporations and ultra-rich instead of working families. In 2018, for the first time in history, billionaires paid taxes at a lower rate than middle class families. Thanks to this law, from 2018 to 2022 there were also 23 successful and profitable companies who paid zero federal taxes. I don’t know many small business owners or working families in Wisconsin who could get away with this, do you?

Luckily, some of the worst provisions of the 2017 law are set to expire after next year, creating an opportunity for Congress to reform the tax code and rebalance it to provide relief to working families in Wisconsin. That’s why I was excited to visit Capitol Hill and ask our elected officials, including Congressman Steil, to make this a priority in the coming months.

These conversations gave me an opportunity to tell them directly that Wisconsinites expect better. We’re tired of seeing our hard-working family members and neighbors being asked to carry more of the burden, while those at the very top are given even more in handouts.

But my visit with Congressman Steil left me without the assurance that he would fight for a tax code that supports people like me. He didn’t agree that today’s tax system disproportionately benefits those at the top and he didn’t commit to allowing provisions of the 2017 Republican Tax Law to expire. This matches closely with his record in Congress. He has co-sponsored legislation which would not only extend many of the law’s provisions, but would make some of them permanent.

This is why it’s so important for Wisconsinites to speak out and demand reform. With many families still feeling the impact of higher costs, we need tax policies that prioritize relief for those who need it, not more handouts to those at the top who are doing just fine.

I hope Wisconsinites join me in making their voices heard. We have a tough fight ahead, but together we can demand that Congress passes this badly-needed reform and help create a stronger economy where everyone can succeed.

Medical debt will no longer appear on credit reports for all Americans

This new rule will erase an estimated $49 billion in unpaid medical bills from the credit reports of roughly 15 million Americans, according to the...

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

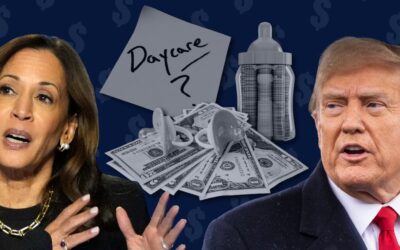

Trump’s tariff and tax plan would raise taxes on 95% of Americans, report finds

In response to the report, the Harris-Walz campaign released an analysis of its own, outlining how Trump’s agenda would raise costs for nearly 2.5...

Trump’s economic plans would worsen inflation, experts say

Mainstream economists warn that Trump's plans to impose huge tariffs on imported goods, deport millions of migrant workers, and demand a voice in...