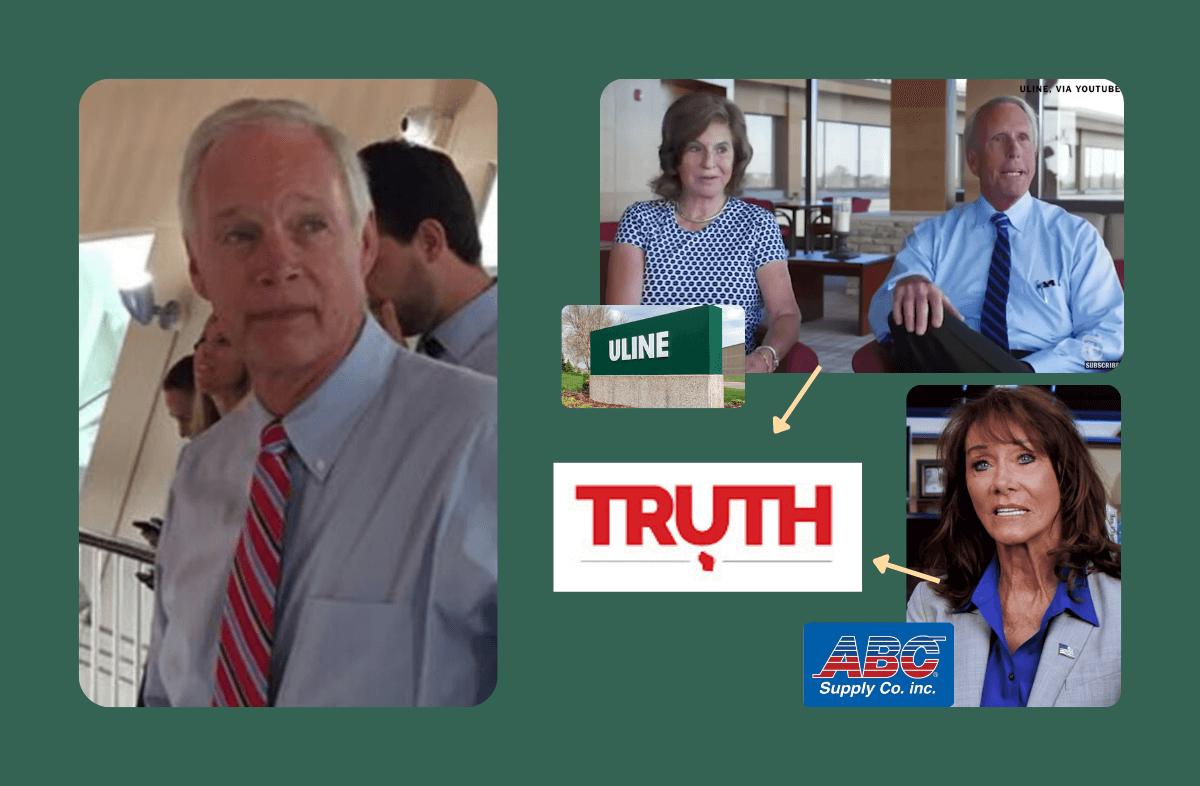

Sen. Ron Johnson (l) is being helped in his reelection effort with outside spending from the new Wisconsin Truth SuperPAC, funded primarily by billionaire owners of Wisconsin businesses who received major tax breaks because of Johnson: Elizabeth and Richard Uihlein of Uline (top right) and Diane Hendricks of ABC Supply Co. (bottom right). (Images from Uline and ABC Supply Co. YouTube pages and Shutterstock)

Hundreds of billions will go toward Medicare after capping a tax change so that its benefits can be focused on small businesses and middle class entrepreneurs.

US Senate Democrats are about to plug a massive tax loophole created four years ago by Wisconsin Republican Sen. Ron Johnson, a sweetheart deal for the super-wealthy that will save taxpayers $200 billion once it’s closed.

The provision Johnson inserted into the Republicans’ 2017 tax bill gives a higher tax-break to pass-through businesses—the kind where no corporate income tax is paid because the income is transferred to individuals who then pay taxes on their own returns, usually at a lower rate.

Johnson often brags that the break benefits small businesses. While technically true, very large companies and very wealthy individuals also take advantage of the tax break since Republicans didn’t put a cap on the benefit. As a result, according to a study done last year by US Dept. of Treasury economists for the National Bureau of Economic Research, more than 60% of the total tax break savings went to the top 1% of wealthiest Americans—and most of that went to the top 0.1%.

Billionaires with Wisconsin ties—Richard and Elizabeth Uihlein and Diane Hendricks—have saved an estimated hundreds of millions of dollars because of Johnson’s provision, according to a report from ProPublica. They have since put millions of dollars toward the creation of the Wisconsin Truth super PAC to run political ads promoting Johnson with a misleading claim about the benefits of their tax break to small businesses. Johnson has also acknowledged benefitting personally from the break he authored.

WATCH: Opportunity Wisconsin ad criticizing Johnson’s tax break.

WATCH: Wisconsin Truth Super PAC ad praising Johnson’s tax break.

The Uihleins have put tens of millions of dollars into right-wing causes, including groups that tried to overturn the 2020 presidential election. They were vocal opponents of Gov. Tony Evers’ coronavirus safeguards and were later infected with COVID while at the White House for former President Donald Trump’s election night party.

On Thursday, Senate Democratic Leader Chuck Schumer of New York and West Virginia Democratic Sen. Joe Manchin said they reached agreement on capping the benefit at $400,000 for individuals and $500,000 for couples—keeping with President Joe Biden’s campaign pledge not to raise taxes on people with an annual income under $400,000. People earning more than those amounts would have to pay a 3.8% tax on their earnings.

The plan will provide $200 billion over a decade to the Medicare trust fund that helps provide health care to America’s elderly and disabled populations.

The original 2017 tax proposal from former President Donald Trump had allowed for business owners to deduct up to 17.4% of their profits, but ProPublica reported the deduction was boosted to 20% to end Johnson’s stated opposition to the original bill.

Politics

New Biden rule protects privacy of women seeking abortions

Under the new rules, state officials and law enforcement cannot obtain medical records related to lawful reproductive health care with the goal of...

Biden marks Earth Day by announcing $7 billion in solar grants

The Biden administration on Monday announced the recipients of its Solar For All Program, a $7 billion climate program that aims to lower energy...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...