(Nataliya Vaitkevich via Pexels)

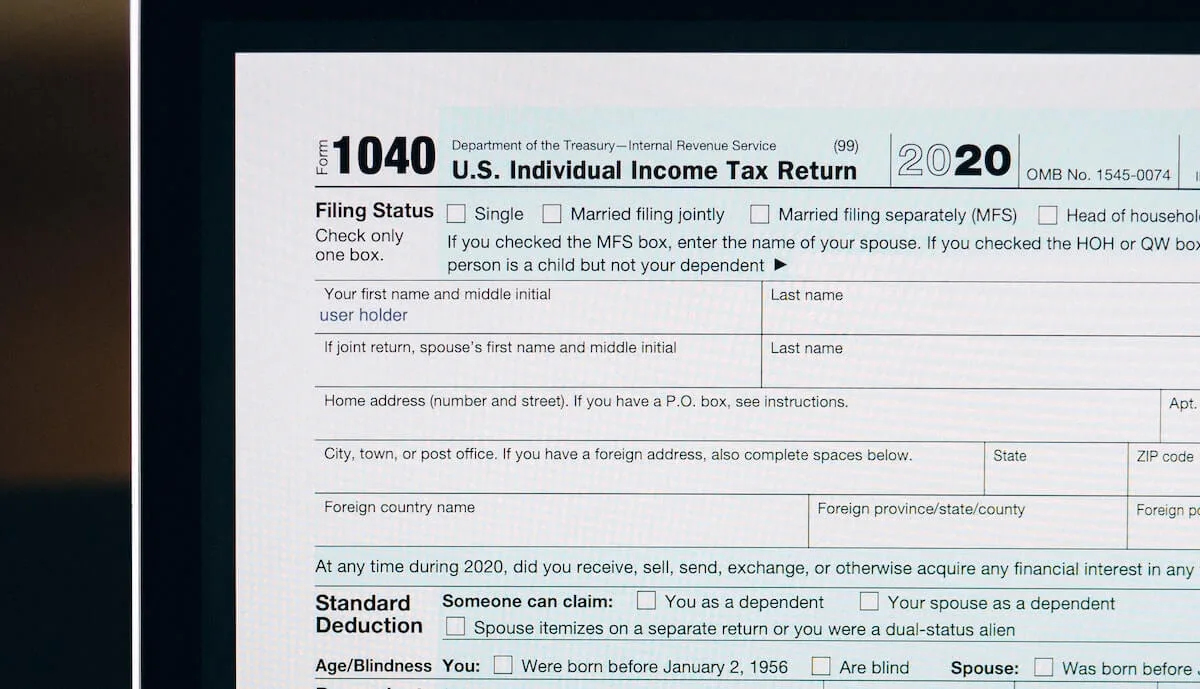

Already a failure in Kansas, the idea would remove a huge chunk—last year, 46%—of what the state uses for schools, roads, medical assistance, and vital services.

A Republican-authored proposal to gradually eliminate the state income tax would further tilt Wisconsin’s tax system to benefit the wealthy and starve essential services like public schools and medical assistance over time, despite its author’s claims of the proposal being an economic boon, according to an analysis by the progressive Wisconsin Budget Project.

Sen. Roger Roth (R-Appleton) recently started gathering co-sponsors for legislation that would lower the state’s income tax whenever the state brings in more income than projected, and there would be no mechanism to raise income tax to make up for revenue shortfalls, ensuring the tax would eventually be eliminated.

“Wisconsin instituted the oldest income tax in the nation, but the time has come for fundamental tax reform which has the promise of transforming the economy in our state,” Roth, who also recently announced a run for lieutenant governor, wrote in a memo to other lawmakers seeking co-sponsors.

Roth’s office did not respond to a request for comment from UpNorthNews.

Without the income tax or a way to make up for the shortfall, Wisconsin could lose out on billions of dollars every year. Last year, the personal income tax accounted for by far the largest share—almost $9.3 billion, or 46%—of the state’s tax income, according to the Department of Revenue. A similar proposal from former Gov. Scott Walker would have raised the state sales tax from 5.5% to 8% to make up for a portion of that shortfall, but Roth’s legislation does not include such a provision.

“It would starve the state of resources, and then what resources we did have would be paid disproportionately by people who can’t afford it,” said Tamarine Cornelius, director of the Budget Project.

Under Wisconsin’s current tax system, the top 20% of earners already pay less as a share of their income than the bottom 80%, according to analysis by the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank.

For example, the top 1% of households, earning $512,600 or more annually, pay an average of 7.7% of their income in taxes, according to ITEP. The bottom 80% pays between 10.1% and 10.6% of their household income.

RELATED: Evers on Budget Surplus: ‘This Is the People’s Money, Give It Back.’

Income tax is what’s referred to as a progressive tax—in other words, the more money a person makes, the more that tax is applied as a percentage of their income. A sales tax is regressive because it applies the same to everyone, thus making it a bigger burden on people with less money to spare.

Eliminating Wisconsin’s income tax would make these disparities even greater, Cornelius said, because it would nix the state’s only progressive tax.

“Already, [the rich] aren’t paying their fair share,” she said. “Well, this would turbocharge that.”

Main Street Alliance, a progressive small business advocacy group, said it is opposed to eliminating the state income tax because it would require substantial cuts to essential government services.

“Fundamentally, small businesses rely on those services—having an educated workforce, having those essential services from government,” said Shawn Phetteplace, Main Street Alliance’s Midwest regional manager.

Nine other states have no income tax. Some, like Florida and Nevada, are buoyed by massive tourism industries.

But in Kansas, for example, a deep rollback of income taxes—with the goal of eventually phasing the tax out entirely—resulted in huge budget shortfalls for roads, bridges, and schools, and the Republican-controlled Legislature repealed the cuts just a few years after they were first enacted. Cornelius and Phetteplace said they feared a similar disastrous outcome in Wisconsin.

“We are not Florida. We are not Texas. We have some tourism, but not enough to be able to realistically make a repeal of the state income tax work,” Phetteplace said.

Opinion: Empowering educators: A call for negotiation rights in Wisconsin

This week marks “Public Schools Week,” highlighting the dedication of teachers, paras, custodians, secretaries and others who collaborate with...

Opinion: The Affordable Care Act saved my life and this is why we have to protect it

The day I turned 26, I didn't give the birthday much thought. It wasn’t a landmark birthday—until it became the birthday that changed my life. On my...

Not just abortion: IVF ruling next phase in the right’s war on reproductive freedom

Nearly two years after the US Supreme Court overturned Roe v. Wade, another court is using that ruling to go after one of the anti-abortion right’s...

Opinion: Students and educators need us now more than ever. This Public Schools Week, commit to celebrating and advocating for them all year long

In this op-ed, Tessa Maglio with Wisconsin Public Education Network highlights Public Schools Week and how to support our schools, educators, and...