#image_title

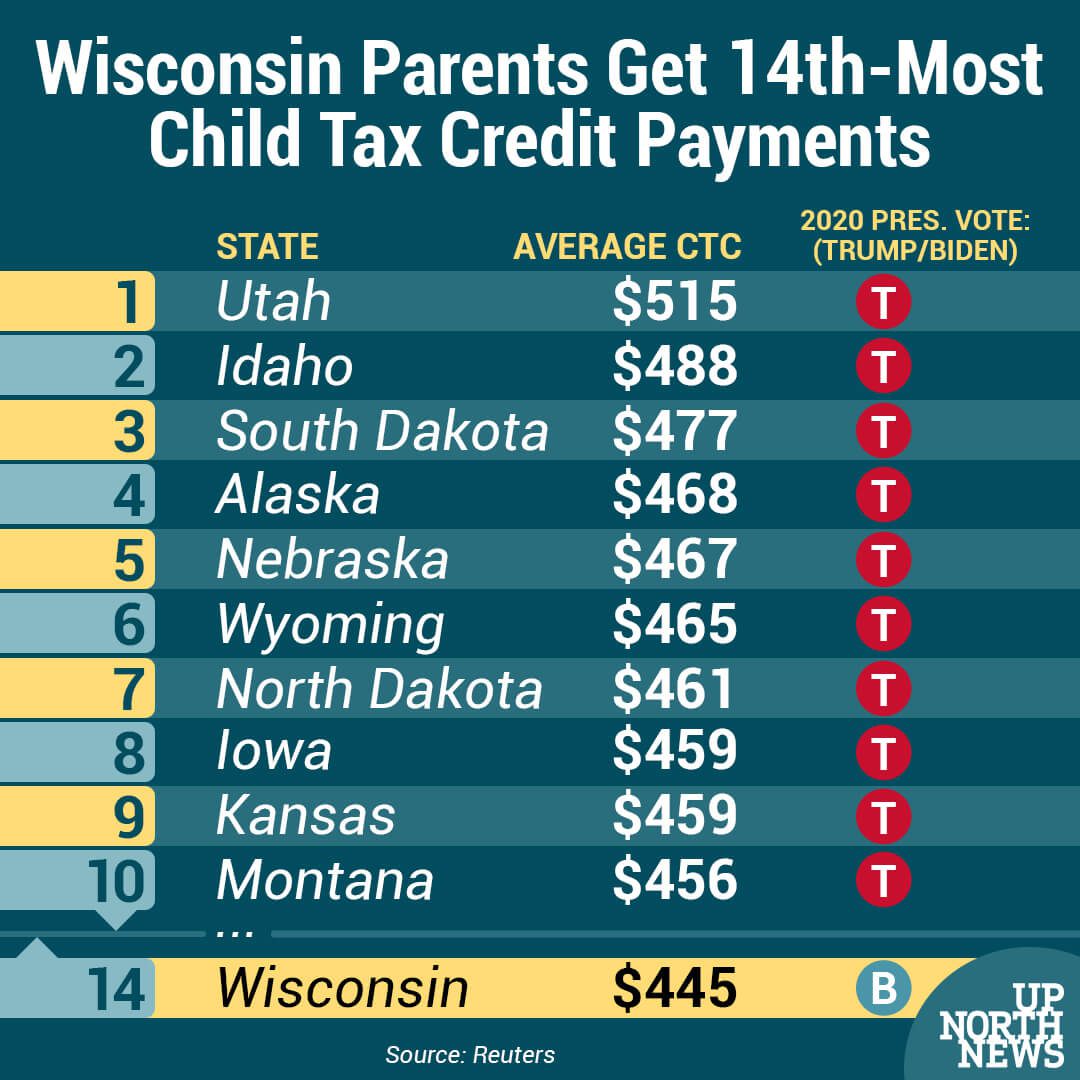

The highest monthly benefits are going to nearly a dozen states that voted for Trump. Wisconsin ranks 14th.

As a new round of monthly child tax credit payments goes to around 35 million American families, a Reuters analysis found Wisconsin is among the states where households are receiving higher-than-average benefits from the expanded credit which was also converted into monthly checks by President Joe Biden’s American Rescue Plan. A Reuters/Ipsos poll also found the expanded credit and payments enjoy broad public support.

The credit, which has been around since 1997, was increased to $3,600 for children under 6 and $3,000 for children ages 6-17 as part of Biden’s coronavirus relief package. The legislation also converted the credit into a monthly payment of $250 or $300 per child rather than an end-of-year lump sum.

The Reuters review shows a disproportionate amount of the child tax credit benefits are going to states that voted for former President Donald Trump. The 10 states receiving the highest average monthly payment all voted for Trump. The change in the child tax credit came with no Republican support as part of the American Rescue Plan passed by a Democratic-controlled Congress in March.

In Wisconsin, the average monthly payment is $445. The national average is $434.

The child tax credit is refundable, a term that means even if a household owes no taxes that the credit would help reduce, the household will get that amount as a cash payment instead. Prior to this year the credit was $2,000 per child age 16 and under.

The full expanded benefit goes to couples making up to $150,000 or $112,500 for a single-parent household. Typically, the credit is applied to taxes that are calculated the following year, but Biden’s plan split the total amount into monthly payments that cover half of the total owed to each household and the other half paid in 2022.

EARLIER: ‘Head Above Water’: Expanded Child Tax Credit Will Help 92% of Wisconsin Children

Analysts say the monthly checks—$300 for each child under age 6 and $250 for the rest—have already significantly reduced childhood poverty. The US Census Bureau found food scarcity dropped 25% in households nationwide after the first round of payments.

The expanded credit is for one year only. Biden has proposed extending the expansion through 2025 as part of what the administration calls a Build Back Better plan working its way through Congress; some Democrats have advocated for making the expansion permanent. If Democrats fail to pass the package—which also includes expanded coverage options for Medicare, Medicaid, home health care, prescription drugs, child care, paid family leave, and no-cost community college—the child tax credit reverts to its previous levels and the monthly payments end. Democrats want to pay for the expansion with higher taxes on households with income of more than $5 million a year and an increase in the corporate tax rate which was slashed under Trump.

The change is favored by 59% of Americans surveyed by Reuters/Ipsos—including 41% of Republicans and 75% of Democrats. The Sept. 9-10 survey of 1,003 Americans has a margin of error of four points.

Wisconsin’s $445 average monthly payment ranks 14th among the 50 states. Utah tops the list with a monthly average of $515. Massachusetts has the lowest average payment at $387. Of states that voted for Biden last November, only Minnesota has a slightly higher average benefit than Wisconsin.

An Axios report on new government data about poverty in America says the monthly checks—coupled with stimulus checks and expanded unemployment benefits—have had a “colossal” impact in reducing poverty, even in one of the worst years ever for the economy due to the coronavirus pandemic.

No Republicans in Congress are expected to support the Build Back Better plan.

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Wisconsinites and our future.

Since day one, our goal here at UpNorthNews has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Wisconsin families—they will be inspired to become civically engaged.

Wisconsin will get hit hardest from Trump’s trade war, analysis shows

The other 49 states have between 1% to 8% of their labor force working in industries getting hit by retaliatory tariffs. Nearly 10% of the Wisconsin...

Opinion: New year, new priorities from Congress? Or more of the same?

Opportunity Wisconsin calls on the state’s Republican Congressional delegation to prioritize Wisconsin families in 2025, though their record casts...

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

Opinion: I asked Congressman Bryan Steil to fight for fair taxes. Will he listen?

A Wisconsin advocate shares her experience advocating for fair taxes during her visit to Washington, DC. Recently, I had the opportunity to join...