#image_title

The issue is more complicated than a choice between government assistance and private insurance.

Throughout the state budget process, Wisconsin’s legislative Republicans repeated the refrain that the state doesn’t need to expand BadgerCare because there is no coverage gap.

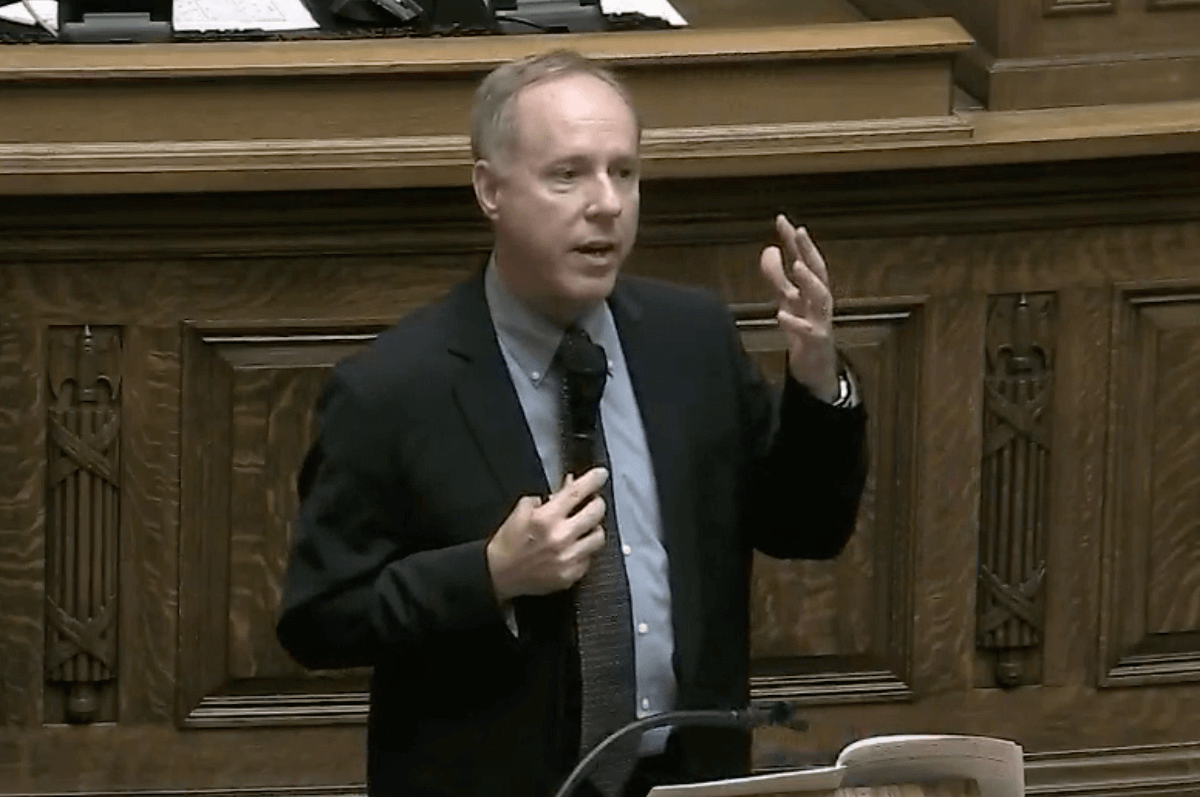

But during debate on the Assembly floor last week on passage of the budget, Assembly Speaker Robin Vos (R-Rochester) testified that not only did he know there was a gap, but that he knew someone who was stuck because of the gap—one of his own employees.

“[She] knows exactly when she hits the cliff. She knows exactly how many hours she can work every month, and at the end of the time that she is able to work, she says, ‘I’ll come back next month,’” said Vos, who owns a popcorn company, a car wash, and a rental agency. “That is the person I think of all the time, who is trapped in a life of poverty because they don’t have the ability to earn a dollar more or they lose their entire benefit.”

Wisconsin is one of just 12 states that haven’t accepted extra federal funding to expand Medicaid, known in Wisconsin as BadgerCare. The expansion would extend coverage to people who earn up to $17,300 per year, rather than the current eligibility cap of $12,800 per year. Wisconsin would extend coverage to 90,000 more low-income people and receive $1.6 billion in additional federal funds for accepting the expansion, but Republicans have repeatedly rejected it.

Vos said his company offers health and dental insurance but that the woman “wants” to be on BadgerCare, ignoring the obvious point that if he and his Republican colleagues expanded BadgerCare, she would be able to earn more and maintain her health benefits. Vos’ office did not immediately respond to a request for comment.

Furthermore, saying his employee “wants” to be on BadgerCare implies that she has a better option or options at all, which health policy experts argue is not the case.

Whether it’s the economic impact private insurance has on a low-income person’s finances or some of the various loopholes that bar them from applying on the healthcare exchange, the issue is more complicated than a choice between government assistance and private insurance.

Dollars and cents

William Parke-Sutherland, a health policy analyst for Kids Forward, argued in his latest article on the Kids Forward website that the so-called affordable healthcare plans offered through the Affordable Care Act (ACA) don’t work for low-income Wisconsinites, like his hypothetical “Howard.”

“Imagine making $15,000 per year and paying for rent, car insurance, gas, food, utilities, clothing, and other household supplies. Adding in even a modest amount for premiums, copays, and deductibles isn’t feasible for Howard,” Parke-Sutherland wrote. “Faced with these seemingly small, but unaffordable, costs, many people like Howard remain uninsured and desperately hope they won’t need expensive medical care.”

In an interview with UpNorth News, Parke-Sutherland pointed out that while the American Rescue Plan has made some low-premium plans available on the ACA’s insurance marketplace for low-income individuals, the difference between private insurance copays and BadgerCare copays can be the difference between seeing a doctor or not.

“The difference between $75 a month for two therapy visits and a dollar to $6 a month for those therapy visits is the difference of you actually seeing a therapist if your income is that low,” Parke-Sutherland said.

RELATED: Wisconsin Could Expand Healthcare and Get $1.6 Billion From the Feds. GOP Says ‘No.’

Claire Zautke, Health Care for All director at Citizen Action of Wisconsin, pointed out that the low-premium plans are not available everywhere in the state. Even in regions where they are available, they may still have deductibles that may look low to someone earning more money, but are prohibitively high for that income level. Even a deductible as low as $700 can be intimidating for someone earning less than $17,000, she said.

“Because as we know, deductibles don’t get spread across an entire year the way premiums do,” Zautke said. “You have to pay that all at once before your plan kicks in.”

And because it’s nearly impossible to know in advance how much a doctor’s visit or procedure will cost, accessing medical care is too high-risk for someone at that income level, she said.

“So that quote-unquote ‘low deductible’ might be the difference between somebody making rent that month. It might be the difference between being able to put gas in your car, food on your table, buy your kids’ school supplies,” Zautke said. “So I think we can’t lose context. We have to keep in mind the context of what that amount of money means to somebody at one moment. It might be somebody’s entire savings.”

For someone in that situation, it makes sense and is more fiscally responsible to earn less money and be able to access health care through BadgerCare than to earn too much and have to pay a premium for a health plan they don’t even use.

“[The question is] not just, is it affordable to purchase the plan, but is it affordable to actually use that plan?” Zautke said.

Loopholes

Even for people who may want to purchase health insurance, there are a few ways that healthcare policy prohibits them from applying and accessing plans on the insurance marketplace.

One, nicknamed the “family glitch,” is where if someone in your family is offered employer-based insurance that is considered affordable by federal standards, but decides not to accept that insurance, they do not qualify for subsidies on the marketplace. But those federal standards only take the plan’s premium into account, not the copays or deductible.

“If you’re working at Walmart, Walmart could offer you a plan that’s a hundred bucks a month with a $6,000 deductible,” Parke-Sutherland said. “And that would be considered affordable by the ACA.”

Not only would that individual be barred from a marketplace subsidy, but so would other members of their family. This also applies to situations where the company-offered individual plan would be considered affordable, but the family plan would not be.

“You have this plan that costs a hundred bucks a month for the one person, but for the family plan that costs $500 a month, which is not atypical at all,” Park-Sutherland said. “The ACA would still only look at what the price is for that individual only plan. So it’s a big problem.”

So while experts have said that expanding BadgerCare would benefit around 91,000 Wisconsinites, between the affordability gap and ACA loopholes, it’s hard to say how many people would gain healthcare access through BadgerCare expansion.

That calculation is even more complicated due to Wisconsin’s partial expansion under former Gov. Scott Walker, which covers BadgerCare for childless people earning under 100% the federal poverty level (FPL). Children in families that earn between 100% and 200% FPL are still covered, but their parents have to purchase private insurance.

Park-Sutherland pointed out that by having parents and children on different healthcare systems, accessing care is even more complicated.

“So right now, we may have a kid in BadgerCare, mom on the marketplace. And so there’s two different provider networks, two different systems to navigate. And if we expanded in that situation, mom would come into BadgerCare and there’d be one network to navigate,” Park-Sutherland said. “We know that when kids and parents are on the same plan, in the same network and have the same network of providers, they’re also more likely to have care and have regular care.”

So in addition to bringing $1.6 billion to the state, expanding BadgerCare would go a long way toward granting thousands of low-income Wisconsinites access to health care, which Zautke argues, at the end of the day, is the right thing to do.

“I resent the efforts by certain politicians to try to divide us neighbor against neighbor, rural person against urban person. Because, you know, really we all have the same interests, which are to live healthy, safe, lives in strong communities,” Zautke said. “And BadgerCare expansion is a way that we can help make that happen. I find it to be totally aligned with our values as Wisconsinites.”

Billionaires get richer while Wisconsinites lose access to health care with ‘Beautiful Bill’

The US Senate will examine the Trump budget bill this week. It includes the largest cut to Medicaid in the program's history. It also blocks...

More ways to get birth control in Wisconsin? Sign us up.

The State Assembly has approved a plan to allow pharmacists to prescribe birth control pills and patches. There could soon be another way for women...

Election 101: If you’ve tuned out until now, here’s what to know for April 1

Wisconsin goes to the polls to decide control of the state Supreme Court and determine who’s in charge of schools—plus a constitutional referendum,...

Opinion: Pentagon contractors don’t save lives or money – Medicaid does. Don’t cut it.

Cutting life-saving services to further enrich billionaires and Pentagon contractors is the worst possible option. This op-ed was first published on...