#image_title

#image_title

GOP lawmakers say they’ve increased funding for schools and cut taxes for the middle class. It’s true on paper, but leaves out some key context.

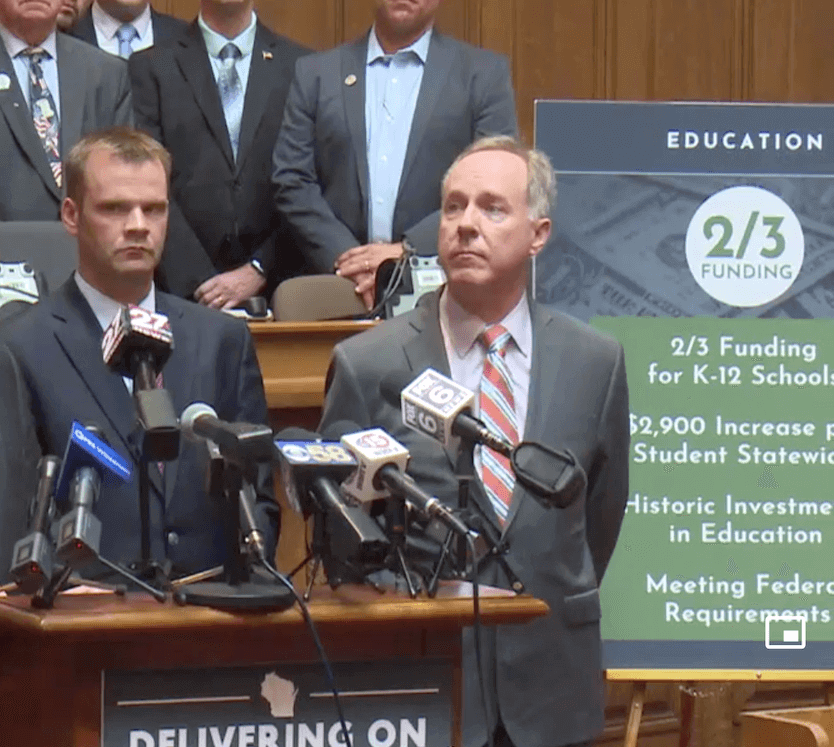

Legislative Republicans were ready for a victory lap even before the vote in the Joint Finance Committee (JFC) on their proposed 2021-23 state budget and tax cut package.

Days earlier, the Legislative Fiscal Bureau had released a memo stating revenues were projected to be much higher than anticipated—$4.4 billion over the next two years. While Republican lawmakers were quick to claim credit for the windfall, the actual memo primarily credited initiatives in President Joe Biden’s American Rescue Plan with getting money in the hands of individuals and small businesses owners.

Democrats on the committee said the additional funds presented an unexpected opportunity for the state to invest in education, infrastructure, and initiatives to improve quality of life while also cutting costs down the line for things such as clean water and public health. But Republicans instead decided to put the money toward a $3 billion tax cut.

Legislative Republicans unveiled their plan with poster boards advertising that the “typical” Wisconsin family would receive about $1,200 in tax cuts; about $900 of that cut would be in income tax and the remainder would be through property tax cuts.

They also stated that they had added $408 million to general aid base funding for K12 education and another $72 million for technical colleges, reaching their goal of two-thirds state funding and meeting the required funding level for districts to access $2.3 billion in federal funds through the American Rescue Plan.

“Once again we are showing [Gov. Tony Evers] leadership,” JFC co-chair Rep. Mark Born (R-Beaver Dam) said during a June 17 press conference. “Whereas he was focused on raising taxes and expanding welfare, we show leadership to invest in our priorities and return money to the hardworking taxpayers of Wisconsin.”

If all of this sounds too good to be true, that’s because it pretty much is.

About that tax cut

Like any policy, the devil is in the details. The Republican motion will reduce the tax rate for the state’s third income bracket from 6.27% to 5.3%.

But that income bracket ranges from people earning $23,930 to $263,480. The $900 savings Republicans touted would only apply to families earning over $100,000; in fact, Democrats pointed out three-quarters of the tax cuts will go to those earning $100,000 or more.

According to the US Census Bureau, the average individual income in Wisconsin is $33,375; median household income is $61,747. For individuals who earn between $40,000 and $50,000 per year, they will receive a tax savings of around $115, according to the Legislative Fiscal Bureau.

Tamarine Cornelius, an analyst with the Wisconsin Budget Project, calculated that individuals who earn $30,000 or less would receive less than half of 1% of the $3.4 billion proposed for tax relief. Such earners make up 42% of all tax filers in Wisconsin.

“Even if you go all the way up to filers earning $60,000 or less, that’s 61% of all filers, and they get just 3.5% of the tax credit,” Cornelius said. “So we’re really [seeing] a very significant allocation of resources that almost completely leaves out people with low income.”

Sen. Jon Erpenbach (D-West Point) called the proposal “a flat tax without being a flat tax,” due to the way it’s skewed toward higher income households.

Democrats proposed using funds to cut taxes for the lowest income brackets, which would otherwise receive no income tax relief, but Republicans voted down the motion.

About that school funding

While Republicans put more funds toward education, schools will not actually be able to receive most of those funds.

That’s because Wisconsin’s school funding formula sets a cap on how much money schools can collect from the combination of state aid and property taxes that makes up most of every school district’s budget.

(Cornelius pointed out that, bizarrely, those per-student rates were set in 1993 and while the caps are raised, the ratios of how much different schools spend per student are frozen at those ‘93 levels.)

So while the Legislature has put more money into education, schools are not allowed to spend it; they are but a conduit for the funds to be passed along as property tax relief.

“If it’s a pie, they’re changing the mix of funding within the pie,” Cornelius said. “They’re putting more state money in and less local property tax, but they’re not making the pie any bigger.”

RELATED: ‘I Feel Like We’re Being Punished’: Schools Push Back Against GOP Budget Plan

What schools are actually getting is an additional $128 million, a 1% increase from the last budget and less than 10% of the increase Evers initially proposed for this budget. The kicker: A Fiscal Bureau memo estimated the average property tax savings homeowners would receive would be just $170 over the next two years.

After JFC Republicans added their tax plan to the budget, school superintendents gave press conferences across the state to speak out against the Republican proposal.

“When people say it’s a shell game, frankly, that is true,” said Chris Thiel, legislative policy manager for Milwaukee Public Schools. “None of this money is going toward the intended purpose of funding education.”

While Republicans and Fiscal Bureau Director Bob Lang said the budget adjustment will make the state qualify for the American Rescue Plan funds, that has not been confirmed by the US Department of Education. It’s up to the department to determine whether those funds count as education spending or not.

The Assembly and Senate are expected to vote on the budget this week, giving Evers a tight deadline to decide whether he’ll approve, veto, or line-veto sections of the budget by the July 1 deadline.

Politics

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Opinion: Trump, GOP fail January 6 truth test

In this op-ed, Milwaukee resident Terry Hansen reflects on the events that took place on January 6, the response from Trump and other GOP members,...

Local News

Readers Poll: Top Bowling Alleys in Wisconsin

Looking for the best bowling in Wisconsin? Look no further! Our readers have spoken in our recent poll, and we have the inside scoop on the top...

8 Wisconsin restaurants Top Chef judges are raving about

Top Chef’s 21st season is all about Wisconsin, and on-screen, it’s already apparent that the judges feel right at home here. But, while filming in...