#image_title

#image_title

Instead of paying its $6.7 million bill, Briggs gave millions to executives.

Briggs & Stratton, a Milwaukee-area juggernaut for more than a century that is now under fire for allegedly unsafe working conditions during the coronavirus pandemic, is at a significant risk of bankruptcy after it skipped a $6.7 million interest payment last month, the Milwaukee Journal Sentinel reports.

The Wauwatosa-headquartered company, which was $581 million in debt as of Dec. 31, has until July 15 to make its skipped interest payment, or else it will default on its credit, according to the Journal Sentinel.

Briggs & Stratton decided last month that it would award its top executives a combined $2.6 million in “retention awards” in lieu of making the interest payment, but employees told UpNorthNews the company has done little to improve essential worker safety, even after an employee collapsed at work and died of the coronavirus soon after.

All the while, the company’s essential manufacturing workers are demanding basic pandemic provisions such as hazard pay, paid sick leave, a mandatory mask policy, and a daily supply of face coverings.

The company has not responded to UpNorthNews’ questions about whether it will meet any of the demands, nor did it respond Monday when asked for comment on the Journal Sentinel story.

Chance Zombor, a grievance representative for United Steelworkers Local 2-232, which represents Briggs employees and one of the organizers of a picket action last Thursday outside the factory, said in a Monday text to UpNorthNews that the company has not yet responded to the demands.

By the end of August, Briggs will also ship 200 Wauwatosa jobs to Sherril, New York, the company announced on June 26. Those jobs account for most of the production in Wisconsin.

In a statement to the Journal Sentinel, Briggs & Stratton spokesman Rick Carpenter said the company is trying to sell “certain businesses and assets” to reduce its debt.

“The COVID-19 impact has been substantial, coming right in the middle of the main part of our selling season,” Carpenter wrote in the statement, according to the Journal Sentinel. “Not only has it out a strain on the business, but capital markets have been extremely volatile at a time when we are trying to refinance our debt.”

Politics

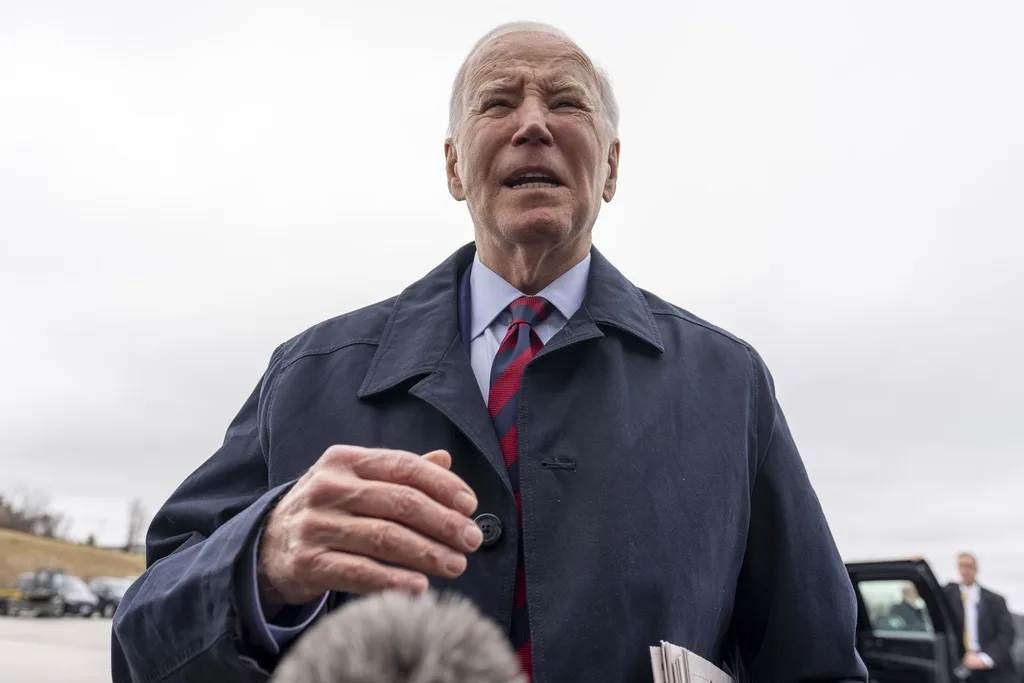

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...

Opinion: Trump, GOP fail January 6 truth test

In this op-ed, Milwaukee resident Terry Hansen reflects on the events that took place on January 6, the response from Trump and other GOP members,...

Local News

Readers Poll: Top Bowling Alleys in Wisconsin

Looking for the best bowling in Wisconsin? Look no further! Our readers have spoken in our recent poll, and we have the inside scoop on the top...

8 Wisconsin restaurants Top Chef judges are raving about

Top Chef’s 21st season is all about Wisconsin, and on-screen, it’s already apparent that the judges feel right at home here. But, while filming in...