#image_title

#image_title

Whether $4.5 billion deal needs a rewrite is now a public spat. Lack of detail fueling speculation.

As Wisconsin taxpayers review their annual property tax bills — itemized line-by-line for school district, county and local governments — they are only now gaining insight into a dispute about whether Foxconn should be more forthcoming in itemizing its intentions in Wisconsin on a project that could ultimately cost taxpayers more than $4 billion.

Gov. Tony Evers and the Taiwan-based electronics maker have each acknowledged the agreement should be renegotiated, but Foxconn has gone silent about what it wants and has instead criticized the Evers administration for saying the firm may no longer qualify for taxpayer funded credits because of past changes and lack of candor about the company’s long-range plans.

As outlined in a story first published by The Verge, Administration Secretary Joel Brennan warned Foxconn in November that its current operations have strayed so far from what was promised that the state may not qualify for future tax credits. The company has still not responded to repeated requests to clarify its intentions except to criticize the request for specificity as “immaterial” and a “distraction.”

The original 2017 deal between Foxconn and then-Governor Scott Walker called for the company to build a $10 billion campus that could employ upwards of 13,000 people building liquid crystal display screens of up to 75 inches. Since then, the company has given mixed signals about whether it is building smaller screens, making other items, or manufacturing anything at all.

To date state taxpayers have spent about $150 million on the facility in Mount Pleasant, according to State Rep. Gordon Hintz, D-Oshkosh. The Assembly Democratic Leader this week responded critically to an editorial from the Racine Journal times that accused Gov. Evers of holding Foxconn tax credits “hostage.”

“Businesses have to adapt to market conditions,” the editorial said. “That means changing what products they manufacture based on demand and other economic factors.”

Hintz responded via Twitter, “The contract was very specific about what was to be built. If they want credits, they need to comply with the contract.”

Republicans who support the original deal say it is still good enough and that the state should not be concerned with the final product line. Rep. Mark Born, R-Beaver Dam, told a local radio show about state credits going to a toolmaker in Sun Prairie.

““I didn’t see anyone saying, ‘are they making cordless screwdrivers or drills’,” said Born, “No one cared.”

For comparison purposes, the Milwaukee Tool expansion in Sun Prairie is forecast to add 30 jobs to the 60 already there.

Skeptics and critics of the Foxconn deal say it is Wisconsin taxpayers who may be the hostages if Foxconn is masking its intentions and trying to run out the clock before the November 2020 elections.

Jon Peacock, Executive Director of the Wisconsin Budget Project, wrote this week about the suspicion that Foxconn’s strategy may have “less to do with what it builds in Wisconsin… and more to do with keeping the favorable trade status the corporation got from President Trump.”

“Some business analysts,” he said, “have suggested that’s the case, and if they are right, it would follow that Foxconn wants to find a way to do enough to stay in the good graces of the President, or to blame someone else if the corporation pulls the plug on the manufacturing in Racine County.”

Peacock said the hardball tactic could also be the result of a change in negotiating tactics once the company realized how much it could lose in a renegotiated deal; or, he said, Foxconn leaders may object to the more transparent system of accountability sought by Evers.

Foxconn is expected to claim that it has now hired more than 520 workers which would qualify the firm to receive tax credits of at least $5 million, according to one analyst. Last year, the company failed to hire the 260 workers necessary to qualify for employment tax credits. Analyst Tamarine Cornelius of the Wisconsin Budget Project said there should be at least 2,080 employees by now for Foxconn to be on target for a 13,000 job goal.

The debate over “tax credits” can be misunderstood to imply the company is getting a discount on actual taxes paid. But because manufacturers in Wisconsin already pay essentially no income tax under legislation passed by a Republican-led legislature in 2011, any credits are essentially a check written to a company by state taxpayers.

If Foxconn were to meet all original criteria for hiring and capital investments, it could receive about $3 billion from Wisconsin taxpayers. Another $1.5 billion in taxpayer dollars is forecast to be spent on infrastructure.

For now, work continues on Foxconn’s initial manufacturing facility which the company said will begin manufacturing in 2020 even if construction is not finalized until 2021. What exactly will be manufactured there remains an open question for a governor who says he is seeking a win-win deal, once Foxconn publicly defines its version of a 2020 win under a renegotiated deal.

Politics

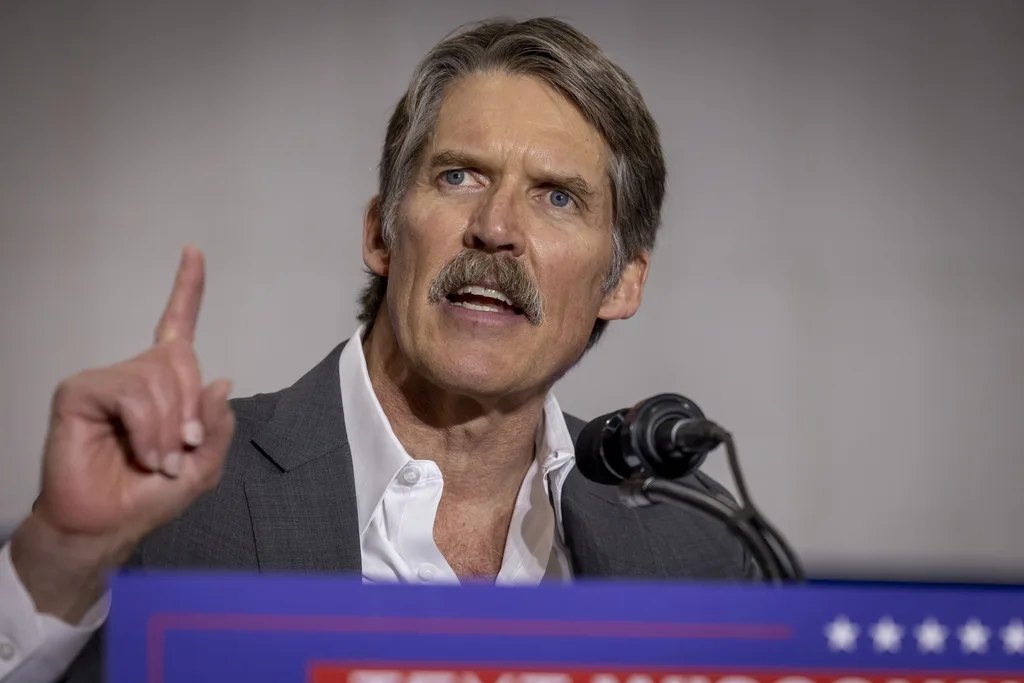

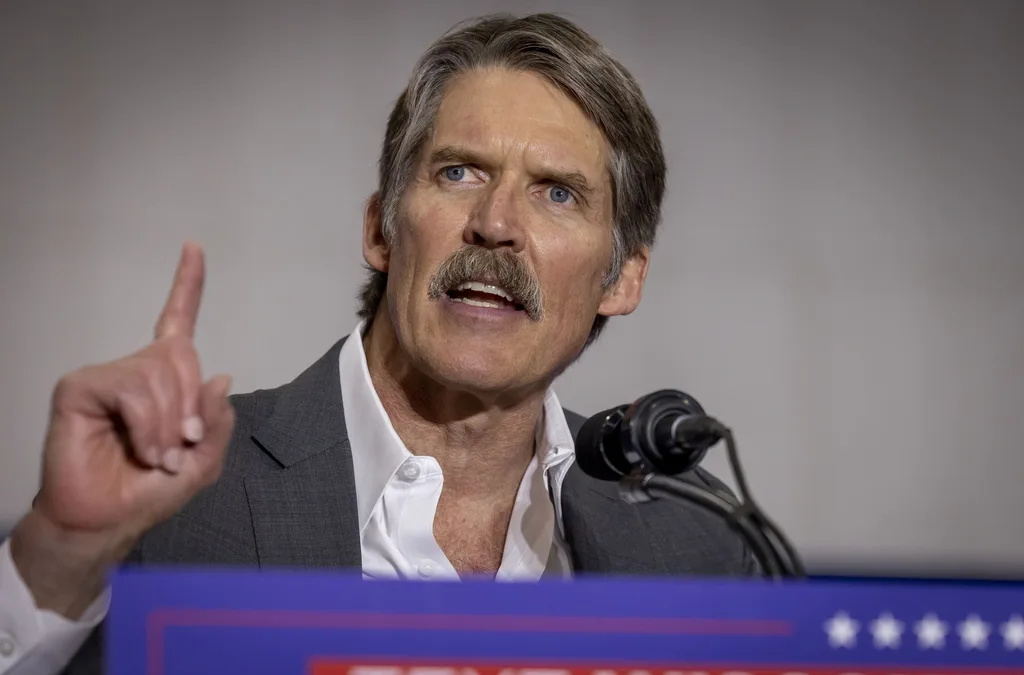

Eric Hovde’s company exposed workers to dangerous chemicals, OSHA reports say

A Madison-based real estate company run by Wisconsin US Senate candidate Eric Hovde settled with the Occupational Safety and Health Administration...

Plugged in: How one Wisconsin school bus driver likes his new electric bus

Electric school buses are gradually being rolled out across the state. They’re still big and yellow, but they’re not loud and don’t smell like...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...