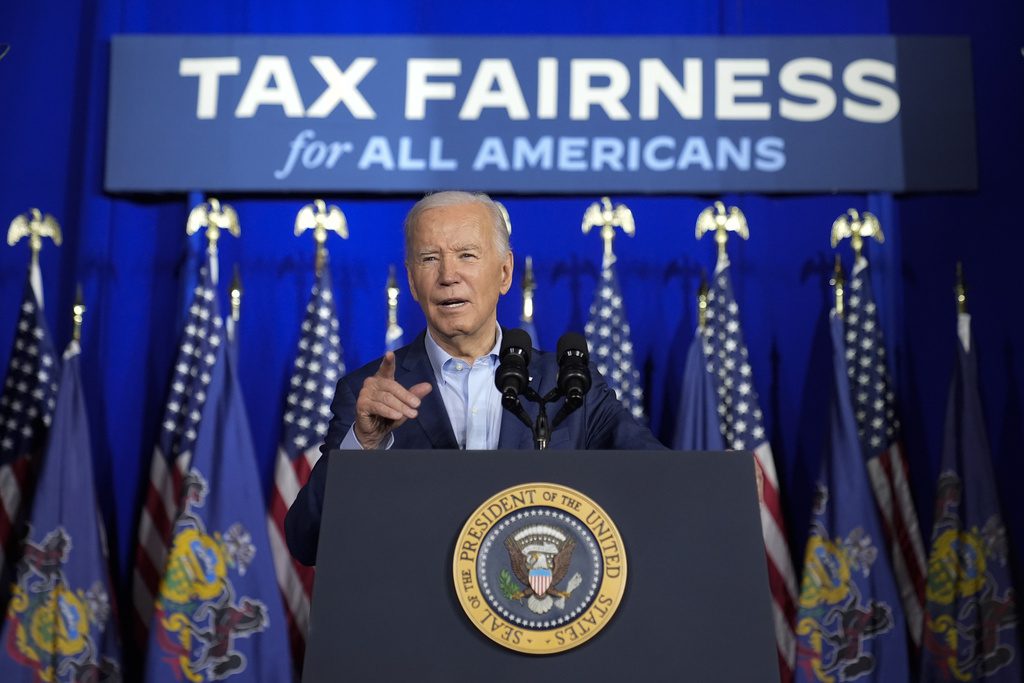

President Joe Biden speaks at a campaign event, Tuesday, April 16, 2024, in Scranton, Pa. Biden has begun three straight days of campaigning in Pennsylvania in his childhood hometown of Scranton. The Democratic president is using the working class city of roughly 75,000 as the backdrop for his pitch for higher taxes on the wealthy. (AP Photo/Alex Brandon)

The president plans to raise taxes on billionaires and giant corporations to help fund more affordable housing and child care, while keeping taxes the same for those earning under $400,000 per year.

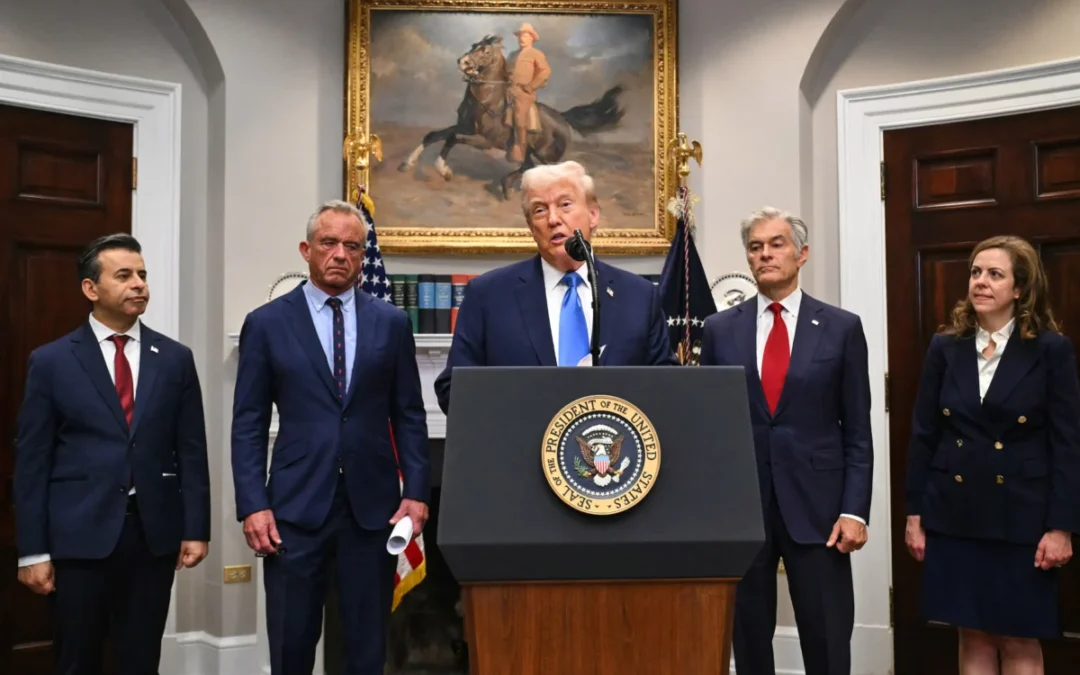

With the 2024 presidential election less than five months away, President Joe Biden and former president Donald Trump have been busy highlighting their tax agendas.

While Trump is promising billionaires yet another massive tax cut for themselves and the companies they run—in some cases as part of a plea for campaign donations—the Biden administration has proposed raising taxes on the country’s wealthiest individuals and corporations.

Biden’s proposed tax increases on billionaires and corporations

Biden has proposed raising taxes on giant corporations and billionaires, which would help fund new investments in affordable housing, child care, and education.

The president released his proposed budget for the 2025 fiscal year in March. It would have Congress offer universal pre-kindergarten, provide 12 weeks of paid family and medical leave, and create a new tax break for first-time home buyers, for example. These efforts would be funded by increasing the corporate tax rate from 21% to 28%.

Biden has also called for a Billionaire Minimum Tax of 25% on America’s wealthiest individuals and increasing the tax on stock buybacks from 1% to 4%.

“The investments in the President’s budget are fully paid for, and the budget would reduce deficits by approximately $3 trillion through a combination of smart savings and tax proposals that ensure wealthy individuals and large corporations pay their fair share,” Secretary of the Treasury Janet L. Yellen said in a statement.

Biden has also pledged not to raise taxes on families earning under $400,000 per year, while allowing Trump’s 2017 tax cuts for individuals—which largely benefited the super rich—to expire for people earning over $400,000 annually.

Biden’s proposals would help address housing and child care costs

Biden’s budget also includes proposals for expanding and cementing tax credits—including the Earned Income Tax Credit and the Low-Income Housing Tax Credit, the latter of which incentivizes production of low-income housing and expands options for renters facing financial challenges.

Biden’s budget also outlines a plan to expand the Child Tax Credit, which helps support families with children by reducing their tax bills. The proposed changes in the budget would increase the amount of money back parents would get and make benefits available to families in monthly installments throughout the year instead of providing a lump sum. The proposal would effectively restore the more generous credit that families received in 2021, thanks to Biden’s American Rescue Plan.

The president’s proposed budget would close Medicare tax loopholes for wealthy Americans, ensuring that individuals making $400,000 or above annually would pay their fair portion toward keeping seniors covered under Medicare. Biden takes a similar stance on Social Security; his budget would require wealthy taxpayers to make greater contributions to the program and strengthen the Social Security Administration with a $1.3 billion budget increase.

Together, the White House says these proposals would help stabilize and strengthen Social Security and Medicare, ensuring they avoid any budget cuts or funding shortfalls.

Increased oversight of the ultra-wealthy

Biden’s Internal Revenue Service (IRS) has also made it a priority to ensure the wealthy and big corporations pay their fair share.

This week, the agency announced it would increase efforts to go after wealthy tax cheats thanks to funding from Biden’s Inflation Reduction Act, which sought to make up for a decade of significant budget cuts to the agency at the hands of Republicans in Congress. Estimates show that this new initiative could result in the collection of $50 billion over 10 years by closing yet another major tax loophole used by business partnerships to avoid paying their taxes.

The agency announced plans last month to significantly increase the audit rates of both large corporations and wealthy taxpayers. The IRS plans to increase the number of audits of taxpayers earning more than $10 million annually by 50% for tax year 2026. The audit rates of corporations with assets over $250 million are expected to triple, meanwhile, and the audit rates of business partnerships with assets over $10 million are expected to increase by tenfold.

The agency will also complete these extra audits using funds provided by the Inflation Reduction Act.

Ensuring that the super wealthy and corporations actually pay their taxes is one of the IRS’ biggest challenges; according to the agency, the tax gap—the difference between taxes owed and taxes paid—has grown to more than $600 billion annually.

A report released earlier this year found that a tax loophole allowed the richest Americans to sit on $8.5 trillion in untaxed profits in 2022.

But thanks to new funding from the Biden administration, the IRS has already collected more than $520 million from 1,600 millionaires who had unpaid tax bills of more than $250,000. Recent estimates from the Treasury Department and the IRS indicate that tax revenues are expected to rise by as much as $561 billion from 2024 to 2034 due to increased enforcement made possible by IRA funding.

“While Trump and MAGA Republicans plan on extending or even expanding their tax scam,” DNC Deputy National Press Secretary Nina Raneses said in a statement, “President Biden and Democrats are fighting to stop corporate price gouging and grow the economy from the bottom up and middle out.”

‘Sick to my stomach’: Trump distorts facts on autism, tylenol, and vaccines, scientists say

By Amy Maxmen Originally published September 22, 2025 Ann Bauer, a researcher who studies Tylenol and autism, felt queasy with anxiety in the weeks...

Do you feel immune to a government shutdown? Think again.

Republicans’ massive cuts to health care have taken the nation closer to a standoff that will impact their constituents’ lives in many ways. Do you...

Review: Wisconsin winners, losers, and liars–the big beautiful budget mess and chaos in Congress

President Trump’s megabill will affect Wisconsin primarily through Medicaid and healthcare cuts. [Editor’s Note: Subscribe to our weekend political...

Everything Wisconsin needs to know about Trump’s cuts to Medicaid and BadgerCare

BadgerCare is what Wisconsin calls its Medicaid program, so let’s learn why Medicaid is so important to more than 1 million people in the state and...