#image_title

#image_title

Many have yet to receive $1,200 federal stimulus check, others competing for dwindling pot of Small Business loan, Paycheck Protection Program funding

When Sheila Nyberg thinks about the small mom-and-pop businesses that line the main streets of most Wisconsin communities, she sees the backbone of the state’s economic engine.

As most of those small operators remain shuttered amid the coronavirus pandemic, Nyberg worries some of them may not reopen when the state’s safer-at-home order implemented on March 25 is lifted.

Nyberg, executive director of the Clark County Economic Development Corporation and Tourism Bureau, works these days with farmers and small business owners trying to stay economically viable as the shutdown continues.

Many have not yet received their $1,200 per-adult stimulus checks from the federal government, she said, and they continue to wait for much-needed aid delayed by demand that in many cases has overwhelmed available funding.

“‘At this point, many people are facing five or six weeks without any income,” Nyberg said. “For so many people, this has become a waiting game. They are trying to access the programs they are eligible for, but in too many cases, they aren’t receiving it fast enough.”

Small business owners, farmers and those helping them access much-needed financial resources report challenges tapping into federal funding intended to help those operations survive until businesses and other activities resume in Wisconsin.

To address that issue, Congress on March 30 approved the $2.2 trillion CARES Act, which included funding through the Paycheck Protection Program, overseen by the Small Business Administration.

Congress initially approved $349 billion for the Small Business Administration’s Paycheck Protection Program. Lawmakers recently replenished that fund after initial dollars ran out by mid-April and another $175 billion has been spent from the fund.

But many small business owners hit hard by the coronavirus pandemic said they are not receiving the help they need because of demand outpacing available funding and rules that preclude some of the smallest businesses from qualifying for assistance.

Altoona resident John Glassbrenner said he was relieved to receive paycheck protection funding totaling $8,500 on Friday to help keep his Eau Claire business, The Attic Home Consignment Store, financially viable. But many small business operators he knows haven’t received program money because they don’t have payroll or didn’t turn a profit last year, he said.

Eligibility for the payroll protection program is based on business payroll costs or net earnings for 2019. To qualify for program funding, business owners must show a net profit for 2019 and/or must have payroll employees.

However, many small business owners have little or no payroll besides themselves, and some operated at a loss last year, especially if they depreciated business expenses.

“I am grateful to have received funding, but I know a lot of others who have not,” Glassbrenner said.

Luke Kempen, director of the Wisconsin Small Business Development Center at UW-Eau Claire, has been working with small business owners and farmers in northwest Wisconsin in recent weeks to help them access PPP. Many small operators struggled to obtain those dollars before they ran out initially, and current PPP rules precluded them from receiving that money, he said.

“It helps people on their taxes,” Kempen said or deductions, “but then they lose out when it comes to accessing PPP payments.”

The PPP loophole also adversely affects small family farmers, said U.S. Sen. Tammy Baldwin, D-Wisconsin. Many family farmers have little or no payroll besides themselves, and many have lost money in recent years as milk prices have remained low.

“In Wisconsin, our farmers are really feeling the dire impacts of this pandemic,” Baldwin told UpNorthNews. “Now more than ever, we must get federal support to the Wisconsin family farmers who need it.”

Baldwin outlined her concerns about struggling farmers in a May 5 letter to Treasury Secretary Steven Mnuchin and SBA Administrator Jovita Carranaza urging the Trump administration to issue new regulations allowing farmers to better access the program. To address the situation, she proposes basing small business owners’ 2019 earnings before interest, taxes, depreciation and amortization are removed.

Wisconsin Farmers Union executive director Julie Keown-Bomar encouraged farmers to apply for the second round of PPP funding, noting they may also be eligible for pandemic unemployment assistance.

“Many farmers don’t have hired help,” Keown-Bomar said, noting the application process has been confusing for many. “They are it, so they were unable to take advantage of the first waves of relief packages.”

Small business owners and farmers also can turn to the Economic Injury Disaster Loan program for financial help. The program provides grants of $1,000 per employee, up to $10,000 total. A husband-and-wife business operation, for example, would qualify for $2,000. Larger loans are also available for those who qualify.

“It helps, but in the big picture it’s not that much money,” Kempen said, “and with the loans, you do have to pay them back.”

High demand for SBA dollars and funding delays are no surprise, Kempen said, noting the program faced an unprecedented request for assistance. At one point the agency disbursed 14 years worth of loans in a typical time in just 14 days.

“The need was so great. It was overwhelming,” he said. “(The SBA) has never had a disaster like this before.”

Kempen questioned whether United States Department of Agriculture funding may be available soon to provide farmers with additional needed money. Such money could be disbursed as soon as mid-May. Nyberg said she hopes additional money is freed up to assist farmers and small business owners.

“For so many people, this is a waiting game without income, and I don’t know how much longer some of them can keep going,” Nyberg said. “We have to do better for them.”

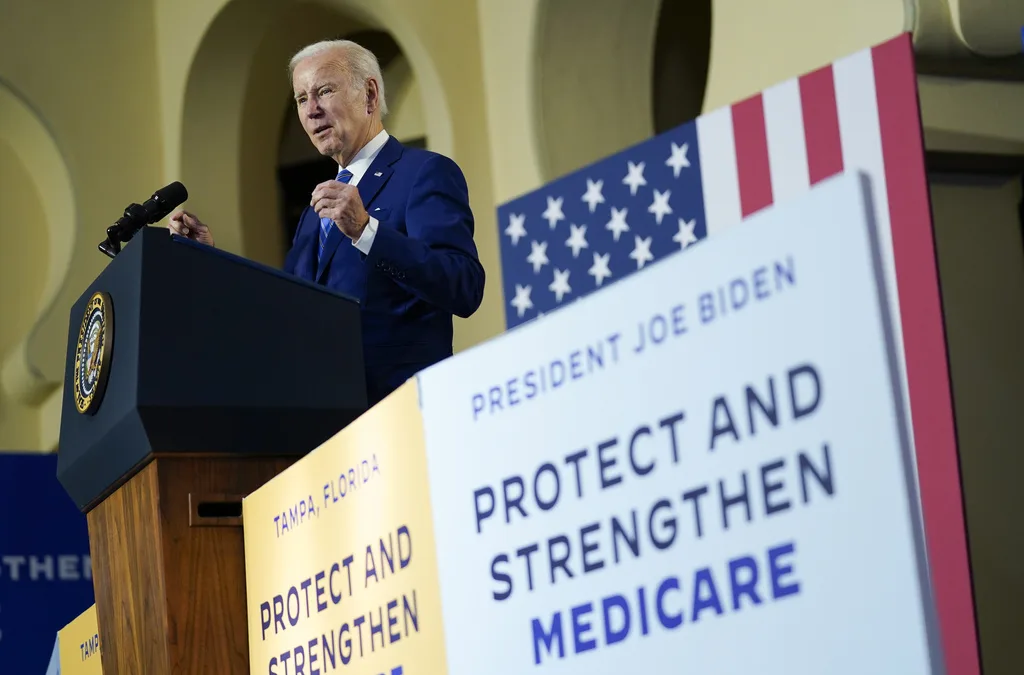

Politics

The Republican war on Medicare raises the stakes in 2024

Nearly 1.3 million Wisconsinites rely on Medicare benefits—benefits they spent decades paying into, with the promise that the program would be there...

Opinion: Donald Trump’s attacks on abortion rights puts politicians between doctors and their patients

In this op-ed, UW-Madison Medical Student, Charlotte Urban, discusses Trump’s attack on abortion rights and health care, emphasizing the importance...

Local News

Where to buy farm-fresh eggs in western Wisconsin

There’s nothing better than eggs from a local farm. Of course, they taste fresher and last longer, but the best part is that you’re supporting a...

13 local bookstores every Wisconsin reader should know

Whether you’re sitting outside enjoying beautiful weather or curling up inside during a snowstorm, it’s always a great time to crack open a book....