#image_title

#image_title

Legislation signed Thursday includes stimulus checks affecting 5.5 million in the state and a broad range of other types of pandemic relief.

[For the latest developments on pandemic relief and vaccination information across Wisconsin, sign up for our daily newsletter.]

The COVID-19 relief plan President Joe Biden signed into law Thursday includes $20 billion to Wisconsin, including $5,600 in direct aid to an eligible family of four, $214 million in tax credit assistance, and an average tax break of $2,510 for families with children—all included in a variety of spending initiatives intended to help people financially amid the ongoing coronavirus pandemic.

“This is not a stimulus package,” said US Rep. Gwen Moore (D-Milwaukee) at a virtual luncheon on Thursday. “This is a rescue package.”

Included in the broad American Rescue Plan that garnered final Congressional approval Wednesday—despite no Republicans backing it—are direct payments of up to $1,400 per person, unemployment assistance, aid to state and local governments, spending for food programs for people in need, and assistance to keep low-income people in their homes.

Tax credits also are part of the $1.9 trillion initiative, as is funding for schools and child care providers, subsidies for health insurance and Medicaid, and additional funding for small businesses, including dollars designated specifically for bars and restaurants.

In addition, the plan provides money for expanding COVID-19 vaccination efforts as well as testing and contact tracing related to the virus. Rural hospitals and healthcare providers would receive funding to help with pandemic-related care. A total of $7.5 billion will be going to the Centers for Disease Control and Prevention (CDC) for vaccine distribution.

Funding is needed by many across the state who continue to face financial hardship as the coronavirus pandemic continues, supporters of the legislation said.

“There will be no shortage of opportunities for us to help out the people of Wisconsin after that money comes in the door,” said Gov. Tony Evers during a Thursday call with reporters. He said he expects funding from the bill will be used “in the same way we have in the past.”

Earlier: ‘Let’s Get This Done, Folks’—Evers’ Radio Address Supports Biden’s COVID Relief Plan

Relief payments to Wisconsin residents and governments will come in a variety of ways.

Stimulus checks

The most direct aid coming to Wisconsinites is $7 billion worth of stimulus payments to 2.7 million eligible households, according to the Congressional Research Service.

To qualify for full payments, individuals can make no more than $75,000 in annual income, and married couples can earn no more than $150,000. Payments are reduced as income climbs, and individuals making at least $80,000 per year and couples paid at least $160,000 will not receive the money.

Stimulus checks are projected to reach as many as 90% of Wisconsin families. That money would benefit an estimated 4 million adults and 1.5 million children.

Unemployment insurance boost

The bill extended the federal unemployment insurance boost of $300 per week until September. House Democrats initially planned to increase the benefit to $400, but Senate Democrats reduced it after objections by Democratic West Virginia Sen. Joe Manchin.

The measure also will make the first $10,200 worth of jobless benefits payments tax-free for households with annual incomes of less than $150,000.

The extended unemployment insurance boost will go to the more than 120,000 Wisconsinites who were jobless as of December, according to the latest figure from the federal Bureau of Labor Statistics. An additional 12,000 people filed an initial unemployment claim the week of Feb. 28 through March 6, according to the Department of Workforce Development, a number more than double the same week last year.

The American Rescue Plan also addresses the hardship of COBRA payments that unemployed workers have to pay if they want to continue to be covered on the plan of their now-former employer. Instead of the newly unemployed worker paying the full premium, the federal government will pay the full premium for six months. And there will be increased subsidies for laid off workers to purchase new coverage through the Affordable Care Act marketplace.

Local government funding

Wisconsin local governments will receive more than $5.7 billion in funding to help make up for revenue shortfalls related to the pandemic, according to a Senate spreadsheet. The state government will receive $3.2 billion, municipalities will get about $1.2 billion, and counties will get $1.1 billion; another $189 million will go to state capital projects.

Individual municipalities will receive assistance based on their size. For example, Neenah will get $5.4 million while Milwaukee is expected to receive about $406 million.

“It makes a huge difference when you’ve just been limping along as a government,” said Kriss Marion, a Lafayette County supervisor, referring to the increased investment in local governments that has come in the past year. Lafayette County will get $3.23 million under the relief bill.

Housing aid

Included in American Rescue Plan funding is $20 billion to state and local governments to help people facing financial struggles with rent, past-due rent payments, and utility bills. Another $10 billion would help qualifying homeowners pay mortgages, and additional funding to assist homeless people.

In Wisconsin, about 215,000 renters have either no or slight confidence to make next month’s rent, according to the most recent biweekly US Census Bureau Household Pulse Survey. Just under 80,000 renters are behind on rent, according to the survey.

Rental assistance payments disbursed by the state have helped keep people in their homes during the pandemic, housing advocates say, but the need for those funds has outpaced available money.

Michael Basford, director of the state Interagency Council on Homelessness, said he is grateful for funding that will help keep people housed.

“This will help many thousands of Wisconsinites to achieve and maintain housing stability as we continue to recover from the pandemic and accompanying economic crisis,” Basford said.

Food assistance

The American Rescue Plan extends the 15% increase in Supplemental Nutrition Assistance Program (SNAP) benefits approved in December through at least September. Qualifying families would receive an added $27 per person monthly, and in Wisconsin, 30% of that increase would go to people with incomes below 50% of the federal poverty level.

In Wisconsin, the plan would boost food assistance funding to those in need by $20 million.

Restaurants and bars

Among the businesses in Wisconsin and elsewhere in the country hit hardest by the pandemic are restaurants and taverns. The relief plan includes $25 billion to help owners pay for a variety of costs, including payroll, mortgage/rent, food and beverages, and utilities.

The plan also makes another $7 billion in Paycheck Protection Program dollars available to businesses, and it expands eligibility to more nonprofit organizations.

Veterans’ Homes

The American Rescue Plan provides $250 million to support state veterans’ homes, including the three in Wisconsin that provide 24-hour skilled nursing care. Wisconsin Veterans Homes at King, Chippewa Falls, and Union Grove would receive an estimated total of $7.1 million, according to Sen. Tammy Baldwin’s office. A staff member for the Wisconsin Democrat says the one-time emergency payments will help improve treatment of veterans during the pandemic with temporarily expanded staffing levels, enhanced cleaning services, and additional PPE.

Tax credits

The COVID-19 relief legislation provides additional tax credits for qualifying Wisconsinites.

The plan boosts the earned income tax credit (EITC) maximum for workers without children from $529 to a maximum of $1,500. Wisconsin is home to about 214,000 childless employees who would gain a projected $214 million from expanding EITC.

The legislation helps Wisconsin families with children as well, providing 98% of families with kids in the state an average tax break of $2,510.

Moore said the child tax credit will “lower the misery index.”

Politics

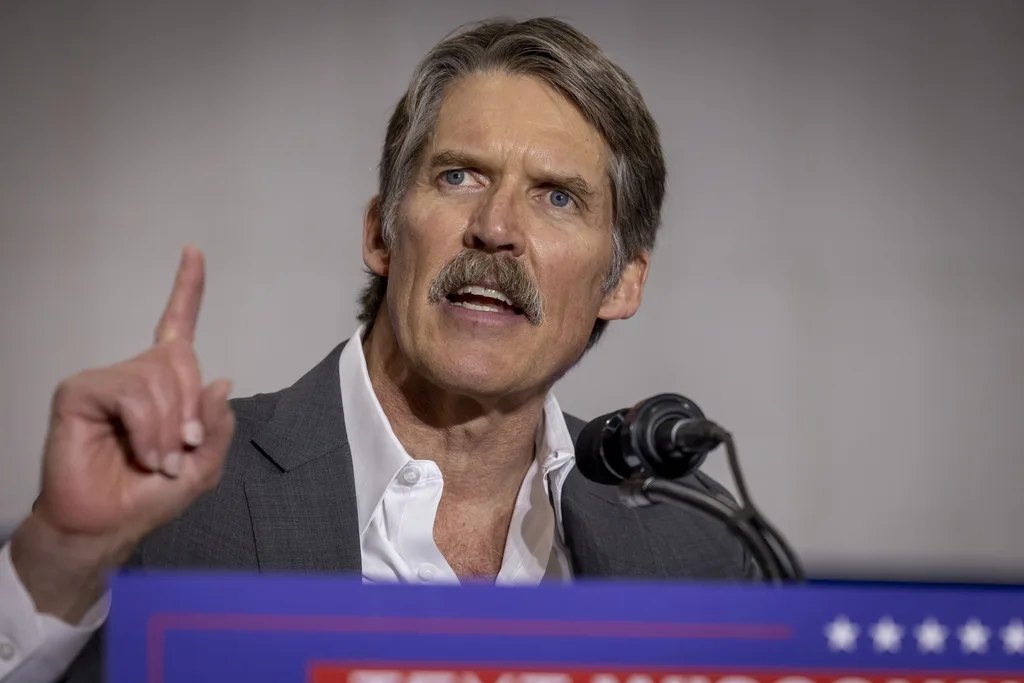

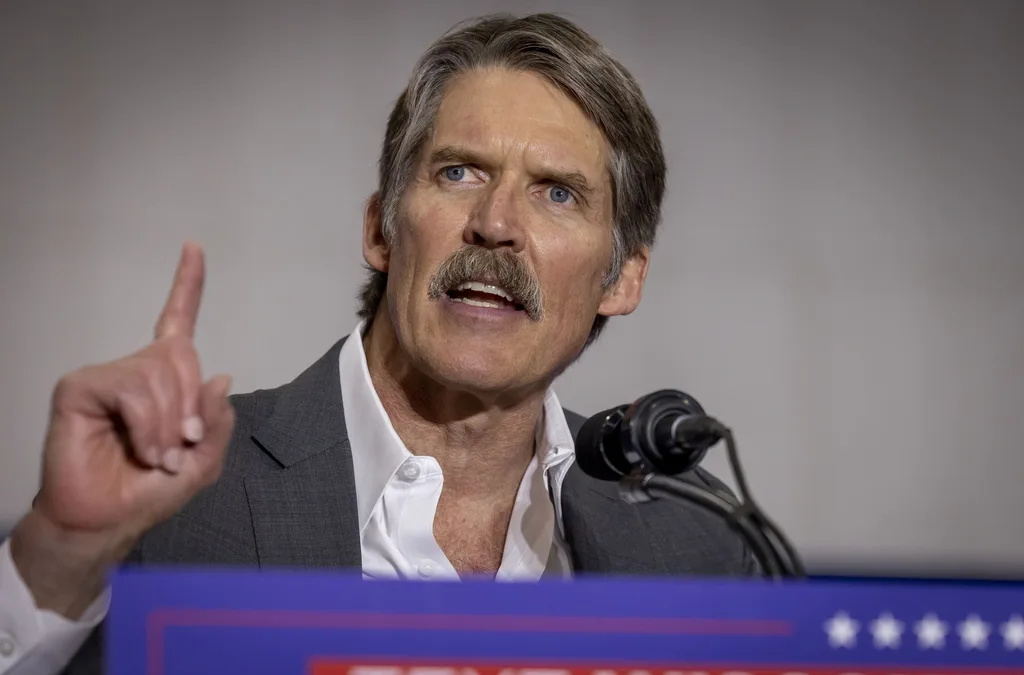

Eric Hovde’s company exposed workers to dangerous chemicals, OSHA reports say

A Madison-based real estate company run by Wisconsin US Senate candidate Eric Hovde settled with the Occupational Safety and Health Administration...

Plugged in: How one Wisconsin school bus driver likes his new electric bus

Electric school buses are gradually being rolled out across the state. They’re still big and yellow, but they’re not loud and don’t smell like...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...