#image_title

#image_title

Most people say they’re not putting away enough money but would if they had access to an automatic plan at work.

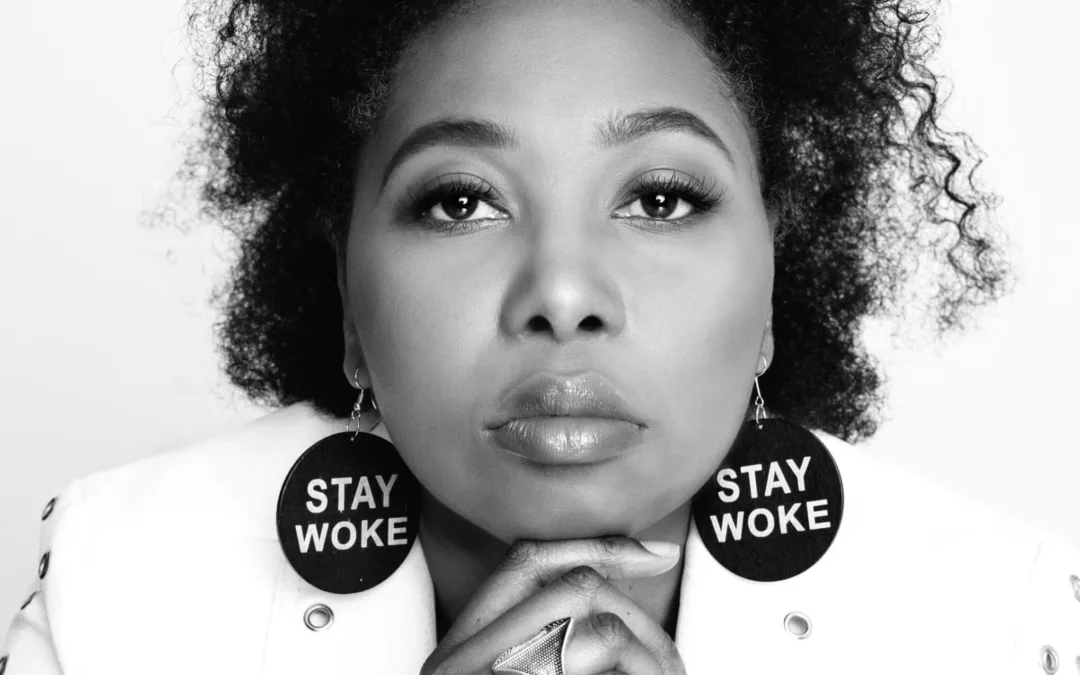

As a 38-year old who recently married, has been employed during her adult life, and is currently manager of the Lew Martin Senior Center in Superior, Jenny Van Sickle would seem to be on the path to a stable retirement someday.

But despite having saved some for retirement through a 401(k) program, Van Sickle said she doesn’t feel she is socking away enough money to be able to retire comfortably at some point. Continued climbing costs of living have fast outpaced her pay raises in recent years, she said, making it more difficult to save for her future.

“This is like everybody I know,” Van Sickle said, “staring down 40 and still not owning a house, still not having much in the way of retirement savings. It’s just not a part of our world. For so many of us, this economy just doesn’t allow many people to have savings the way it used to.”

Statistics show Van Sickle, a member of the Superior City Council, is far from alone. According to the state Treasurer’s Office, 88% of Wisconsin voters don’t feel they are financially prepared to retire. In the state, 930,000 people currently working don’t have access to a retirement plan through their place of employment.

An initiative released earlier this month would aid retirement savings opportunities for state residents in a variety of ways. The Governor’s Task Force on Retirement Savings, established in the fall of 2019, made five recommendations to help people accrue more money to live more comfortably in their post-work lives.

One of those recommendations is the creation of a new program called WisconsinSaves, which would enable employees to automatically enroll in an IRA program through the places where they work. The effort would establish the infrastructure allowing workers to automatically deduct a portion of paycheck earnings into an account managed by financial experts, meaning businesses would not be responsible for having to enact such a system.

Surveys show people are 15 times more likely to save if they have a retirement plan through the workplace, and 20 times more likely if the plan is automatic, removing the temptation to put off the small deductions in the present that can make the future a lot less stressful.

Another highlight of the task force’s proposals is the 401(K)ids program that would provide every child born in the state with an investment account so they could begin earning money on investments early on. The effort would impact about 60,000 children born each year and would be the first of its kind in the US.

The plan also includes an emergency savings structure that allows withdrawals from the accounts for monetary emergencies without tapping into retirement savings, incentivized participation for businesses, and an interactive e-commerce system that would be a centralized information source for the program.

The proposals would not have a cost to businesses, state Treasurer Sarah Godlewski said. They would be administered by a public-private partnership that would include investment management and record keeping by the financial services industry that the state would contract with. The state, with oversight from a public board, would design and implement the program, which would be managed and invested separately from the state retirement plan.

Earlier: State Treasurer Forms Group to Identify and Assist Homeowners Close to Eviction

Plans similar to WisconsinSaves and 401(K)ids were included as part of Gov. Tony Evers’ proposed 2021-23 state budget, along with $2 million in funding. Whether or not those and the other three task force initiatives will make it as part of the budget or be acted on in separate legislative action by the Republican-led Legislature remains to be seen.

The task force effort was bipartisan, Godlewski said, and she is optimistic that spirit will carry over into legislative action.

“Increasing people’s retirement savings without adversely impacting businesses is an idea members of both political parties should be able to get behind,” she said.

Efforts to establish retirement for children have been discussed for years by the federal government but never enacted. On Feb. 5 Sen. Tammy Baldwin (D-Wis.) joined Sen. Cory Booker (D-New Jersey) and US Rep. Ayanna Pressley (D-Mass.) to introduce legislation to provide retirement funding for every American child at birth.

Some other states have adopted various versions of statewide retirement plans. Illinois is beginning an initiative soon, Godlewski said, and Oregon did so three years ago. Today about 80,000 workers are part of Oregon’s retirement plan that is worth more than $80 million.

Such efforts work in large part simply because of compound interest, she said. For example, a $500 initial investment in a person’s retirement account when they are born, if no money is subsequently added, would total more than $43,000 by the time that person would retire, using a 7% annual growth rate.

“Reaping the benefits of compound interest can make a huge difference for so many families in Wisconsin,” Godlewski said.

Facing a crisis

The task force conducted numerous hearings across the state, gathering input from business owners, retirees and others who discussed impediments to accumulating retirement savings. That information and statistical data showing that many in Wisconsin reach retirement without adequate funding informed the task force’s recommendations, Godlewski said.

“It became quite clear that Wisconsin is facing a retirement crisis,” she told UpNorthNews. “We’ve got to act now to make sure that our friends, our neighbors, are out of poverty.”

Many people retire with little in the way of the way of savings for life after work. In fact, the average retirement savings in Wisconsin is just $12,000, Godlewski said, and many state residents have no money put aside and subsist on only their Social Security earnings, often less than $1,000 per person per month.

If something isn’t done to address the many people without sufficient retirement funds, projections show more than 400,000 people age 65 and older in Wisconsin will live in poverty by 2030, Godlewski said. If that happens, she said, the state will spend an additional $3.5 billion on public assistance programs for that population.

Van Sickle works firsthand with many elderly residents who need that assistance to get by. Nearly 300 people show up at the senior center she oversees in downtown Superior to collect food given away there. The giveaway that occurred monthly now happens once every two months since the coronavirus pandemic began in March.

To receive the free food, people must be 60 or older and can earn no more income than 130% of the federal poverty limit, $1,383 per month for a single person or $1,868 for a family of two. When Van Sickel helps applicants fill out paperwork, most scoff at those numbers because they make so much less than that, she said.

“In my three years here, I’ve never had a senior come in and apply and be above those figures,” she said. “They look at me and say ‘My income isn’t anywhere near that.’ ”

Godlewski recalled a task force listening session in Kenosha at which one woman in her 60s discussed her concerns about a lack of retirement savings for many. Godlewski figured the woman would talk about how she didn’t have enough money set aside.

In fact, Godlewski said, that woman had a decent amount for her retirement, and instead told the task force she was concerned about her three children, all of them in their 30s and none of them with retirement accounts in place.

“This isn’t just about seniors who don’t have enough money,” Godlewski said. “It’s also about middle-age and younger people who either don’t have access to retirement savings accounts, or don’t feel they have enough money to save for retirement. We have to do something to change that, and that is what the task force recommendations are aimed at doing.”

Assistance needed

When Don Anderson started his Professional Vegetation Management Services business near Plover in 1986, he didn’t worry about providing retirement savings plans. At that time the business consisted of him and one other employee.

But as his company grew, Anderson, 65, felt the need to offer benefits to his workers. Last year he attempted to establish a retirement savings plan for the eight employees there, but challenges setting up an automatic individual retirement account system, and costs associated with a 401K plan intended for larger operations, got in the way.

Instead of installing such a system, Anderson eventually gave his employees extra cash and advised them to invest it for their retirements, he said.

“We tried to set up individual retirement accounts, but it was a real headache,” Anderson said. “A lot of small businesses just don’t have the resources to do that.”

Jerry Lynn, a retirement expert from the Milwaukee area who served on the task force, said needs of small businesses and others related to challenges saving for retirement directly shaped the group’s recommendations. Providing an infrastructure to enable savings plans is key to making it easier for people to begin to put away money for retirement, he said.

“We can take away the initial hurdle of people and small businesses not knowing how to set up enrollment in retirement accounts,” Lynn said. “If we can do that on a statewide basis, this could be a game changer for a lot of people.”

After 36 years working as a school librarian in the DC Everest school district, Beth Martin retired prior to this school year, in large part because of her fears about being in the classroom amid the coronavirus pandemic.

Martin, a 61-year-old Wausua school board member, had earned a decent wage and had good benefits through the school district. Her husband Jeff had worked at various jobs before retiring two years ago and had built up a 401K account to go with Social Security payments.

But thanks in part to college debt Martin incurred later in life obtaining her master’s degree, she and her husband, despite being middle class, struggled to be able to retire. To make that possible, the couple refinanced their home, extending payments for 10 years, to allow them to pay off debt, Martin said.

“To live on our income, we needed to be paying fewer bills,” Martin said. “And we are much better off than many people who don’t have retirement accounts at all. I can’t imagine what it must be like for them.”

Van Sickle is reminded of that every time she meets with one of her senior center clients, every time she packs up boxes of food and hands it to them. She sees the expressions of worry etched on their faces, hears the concern in their voices as she listens to them describe their struggles to make ends meet, how they exist on only meager Social Security payments.

“There are so many seniors in this county living in poverty, so many people who were never able to save money, or who never had access to retirement savings in the first place,” Van Sickle said. “We have the means to do better by our senior citizens, and for every Wisconsinite of every age. It’s past time that we do.”

Politics

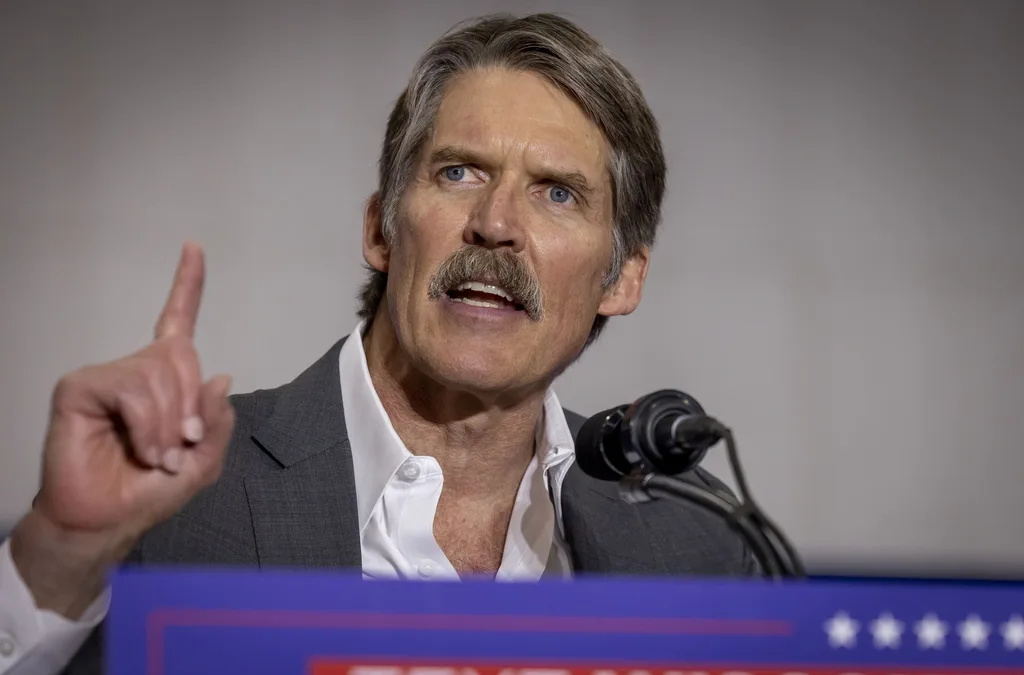

Eric Hovde’s company exposed workers to dangerous chemicals, OSHA reports say

A Madison-based real estate company run by Wisconsin US Senate candidate Eric Hovde settled with the Occupational Safety and Health Administration...

Plugged in: How one Wisconsin school bus driver likes his new electric bus

Electric school buses are gradually being rolled out across the state. They’re still big and yellow, but they’re not loud and don’t smell like...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...